RWA

Real-World Assets powered by blockchain technology is a world where traditional assets such as real estate, commodities, and even fine art are tokenized. Through blockchain, ownership of these assets becomes more transparent, secure, and efficient, opening up new avenues for investment and liquidity.

What are Real-World Assets (RWA)?

Real-World Assets (RWA) refer to the representation of physical assets in the digital space, typically through the use of tokens. These tokens allow for ownership and fractional shares in tangible goods such as real estate, gold, land, and other physical properties. By tokenizing these assets, it becomes possible to trade, transfer, and manage ownership digitally, offering greater liquidity and accessibility to investors. This fusion of traditional assets with blockchain technology not only democratizes access to investment opportunities but also enhances the verification and tracking of asset histories. Tokenization of RWAs bridges the gap between physical and digital markets, enabling more efficient and transparent transactions.

Approach to RWA ownership

The most critical aspect of Real-World Asset (RWA) ownership is creating a fully backed economic system to eliminate the risk of uncovered liabilities and foster trust among users. Implementing transparent verification mechanisms, such as blockchain-based proof of reserves and third-party audits, reassures users of the system’s reliability. Compliance with relevant legal frameworks provides additional security. Developing robust risk management strategies protects against market volatility and fraud. Finally, intuitive platforms for purchasing, trading, and managing tokenized assets encourage wider adoption and trust. This approach ensures a stable and trustworthy system for RWA ownership.

What areas do we help in?

Creation of Asset-Backed Token Models

We specialize in creating models that ensure each token is fully backed by a real-world asset. This approach eliminates the risk of uncovered liabilities, fostering trust among users. Our team translates complex economic and financial concepts into precise models that guarantee transparency and stability, ensuring that every token corresponds to an actual physical asset.

Distribution of Tokens

Our team assists in planning the distribution of your tokens, ensuring a strategic approach that maximizes user engagement and value. We develop comprehensive distribution strategies that align with your project goals, creating a seamless and effective process for reaching your target audience and achieving widespread adoption.

Mapping a System

To enhance the understanding of complex Web3 project systems, our token engineers utilize advanced visualization techniques. They convert the entire project into a Stock&Flow model and provide visual representations of all agents within the system. These practices significantly improve the comprehension of asset flows and are instrumental in pinpointing potential challenges.

Attractiveness of the System and Incentive Mechanisms

We enhance the attractiveness of your system by implementing innovative incentive mechanisms that motivate user participation and investment. By carefully designing rewards and benefits that resonate with your target audience, we help boost user engagement and retention. Our strategies are tailored to ensure that the incentives not only align with the project’s objectives but also add significant value, making your platform more appealing to current and potential users.

Risk Management for RWAs

Protect your real-world asset investments with effective risk management strategies. Our specialized solutions mitigate risks and safeguard your project by offering comprehensive risk assessments. We identify potential threats and vulnerabilities in your ecosystem and develop tailored strategies to address risks related to market volatility, regulatory compliance, cybersecurity, and more, ensuring the stability and security of your platform.

Validation and Optimization of Assumptions

Our engineers specialize in validating the assumptions underlying your RWA project. By running hundreds of scenarios through simulation processes, we identify potential opportunities and threats, providing detailed recommendations to optimize your system. This includes proposing solutions to existing problems, methods to capitalize on growth opportunities, and fine-tuning mechanisms for optimal performance. This final step is crucial for ensuring the long-term development and success of your project.

Let’s Collaborate

Whether you have questions, collaboration ideas, or just want to say hello, we’re here and ready to connect. Your inquiries are important to us, and we look forward to engaging in meaningful conversations.

We specialize in six key areas to ensure the success of your RWA project

System Discovery

We enhance your RWA project idea into concrete solutions and mechanisms, leveraging the experience and research of our team.

System Mapping

We map your system using methods such as Stock & Flow and agent relationship mapping to understand every asset flow and motivation within the RWA system.

Mathematical Specification

Every mechanism we propose comes with a complete mathematical specification and working examples, making it understandable even for non-technical stakeholders and serving as guidelines for developers.

Digital Twin Creation

We create a digital twin, coded in CadCAD within a Python environment, which replicates your entire economic system before implementation.

Validation

This allows us to test the functionality and potential of all mechanisms, as well as understand the system dynamics, all before starting to write smart contracts. We anticipate project behavior under various conditions to test its resilience and adaptability.

Technical Implementation

Based on the created and validated system specification, we proceed to implement smart contracts. This step translates theoretical solutions into working technological components.

Building Trust Starts Here

Our company was founded on the principle of trust, a vital element in the rapidly evolving crypto and blockchain industry. We aim to demystify the complexities of crypto-economics, providing clear and reliable guidance.

Our focus is to build strong, trust-based relationships with our clients, ensuring they feel confident and supported as they navigate the cryptocurrency landscape with us as their trusted partner.

Frequently asked questions

Case Study

DePIN – Decentralized Physical Infrastructure Networks Explained

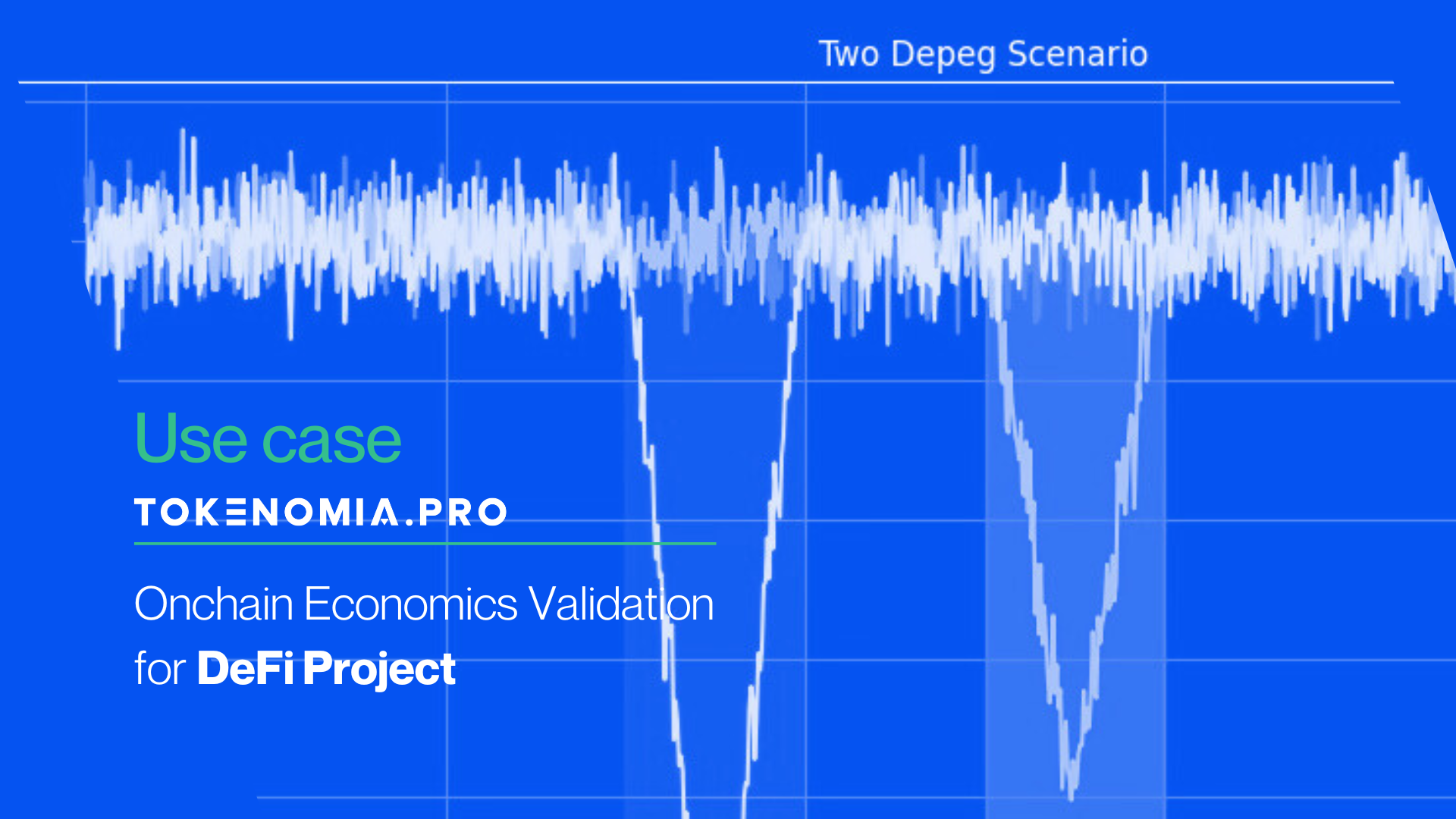

DeFi Onchain Economics Validation

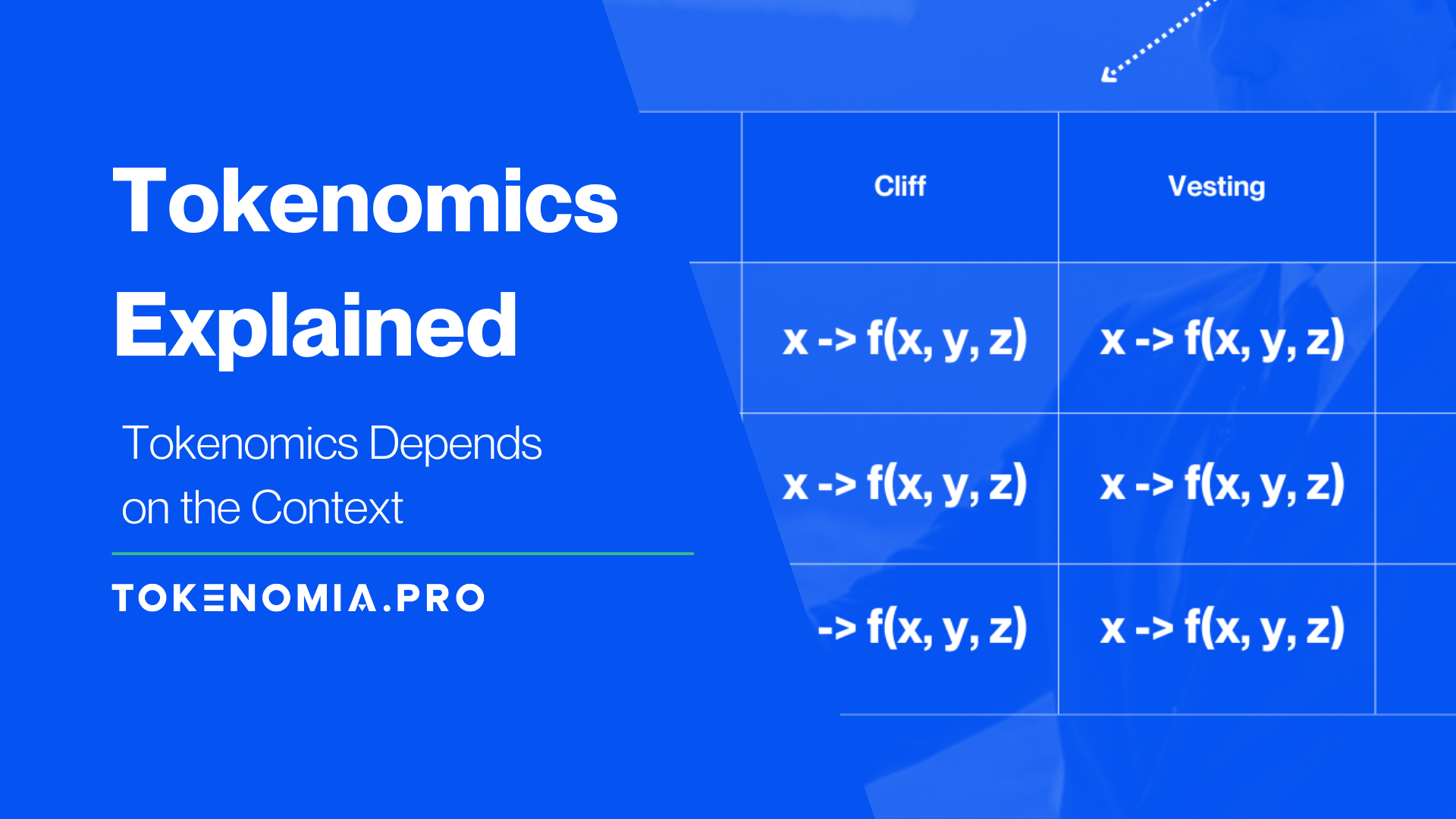

Tokenomics Explained – Tokenomics Depends on the context

What do our clients say?

Consulting Company 2023

Recognition

Let’s Collaborate

Whether you have questions, collaboration ideas, or just want to say hello, we’re here and ready to connect. Your inquiries are important to us, and we look forward to engaging in meaningful conversations.