15 minutes read

15 minutes readTable of contents

NFT Customer Engagement Platform with Tokens Cashback

Who will benefit from this case?

If you want to know how to combine e-commerce with blockchain, this use case is for you. Below is an example of work for our client that represents a combination of two worlds. The first world is e-commerce, representing Web2 technology. The second is blockchain, NFT, and Fungible Tokens, representing Web3 technology. A combination of both gives us what we call Web2.5.

Who is our client, and what were his goals?

Loyalz.io’s vision is to introduce an interoperable, all in one, Web3 Customer Engagement Platform that increases loyalty and customer retention, offers tokenized cashback and rewards customers for engagement. SaaS platform integrates NFT collections, tokenized rewards, and engaging utilities, specifically designed to enhance e-commerce loyalty, ultimately resulting in an improved LTV/CAC ratio.

Problems and Solutions

Problem 1: How to create tokenomics tied to the product. The token should have financial coverage.

Tokenomia.pro Solution:

We divide the project implementation into two main phases:

- The first phase, before listing the Loyalz Token, is inflationary

- The post-listing phase is deflationary.

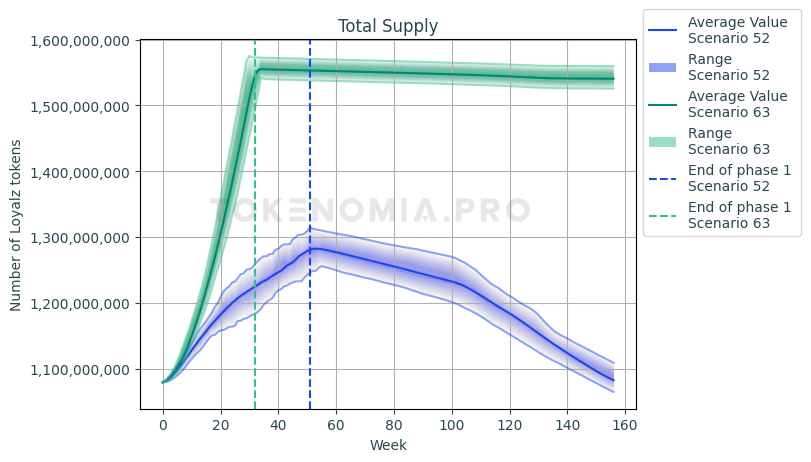

During the inflationary phase, the Loyalz token pool has no supply limits. Brands receive tokens based on the amount of FIAT collected for NFT collections. The Loyalz burning mechanism is turned off. Instead, the tokens that would be burned are put into staking pools. Product prices in Loyalz and cashback discounts stay the same. Users cannot sell Loyalz tokens.

The number of brands in the system determines the Loyalz token pool during the Deflationary Phase. Loyalz.io acquires Loyalz tokens from Charitable Organizations and Brands. It exchanges Loyalz for funds by selling NFT collections. Some of these funds are also put into staking pools. The Loyalz burning mechanism involves burning a certain percentage of transactions on the secondary market. It also involves burning a certain percentage of transactions for Loyalz purchases by Loyalz.io. Users can sell Loyalz on the exchange, which affects product prices and cashback in Loyalz.

Effect: Thanks to this solution, supply and demand mechanisms regulate themselves. This makes the total supply of the Loyalz Token attractive in the long run. This also translates into an increase in its value by limiting availability.

Learn more about Token Engineering Services: https://tokenomia.pro/token-engineering/

Problem 2: What should be the sustainable business logic for distributing NFT-based loyalty cards.

Tokenomia.pro solution:

Brands have control over NFT collections. They control the quantity, price, appearance, distribution, and purchasing model. Customers can receive NFTs for free or choose to pay (in Loyalz or FIAT). The distribution process may be available to everyone. It may depend on specific conditions met by the customer.

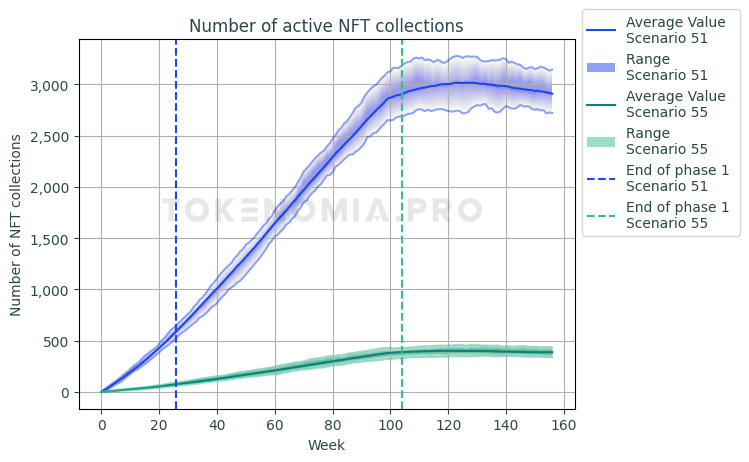

Effect: The number of customers or demand for NFT tokens is directly proportional to the number of brands in the system. Even if new brands stop joining the system, new NFT collections will still emerge.

Learn more about Incentive Optimisation Services: https://tokenomia.pro/blockchain-consulting-incentive-optimisation/

Problem 3: How to minimize the risk of draining staking and cashback systems.

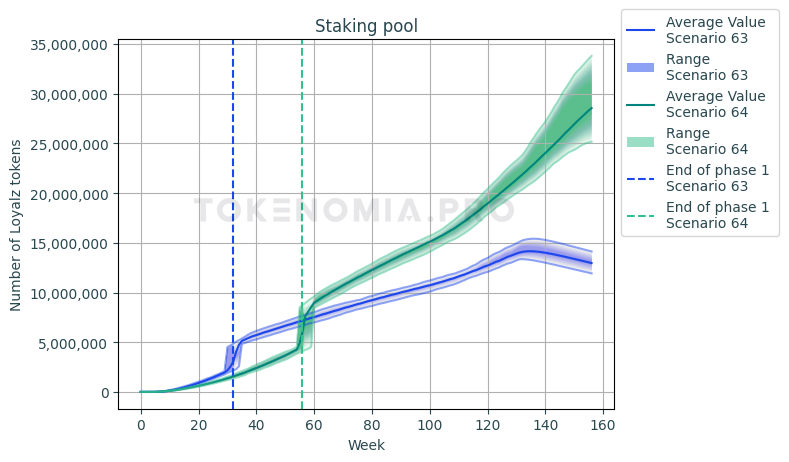

Staking: In the system, there are two types of staking. Classic staking involves users freezing tokens for a specified period, with Loyalz tokens as rewards. The second type is staking, where rewards come in the form of services or products from brands.

Cashback: When a user purchases a product or service from a brand, they receive a corresponding number of Loyalz tokens. This allocation occurs with a delay, taking into account the product return period.

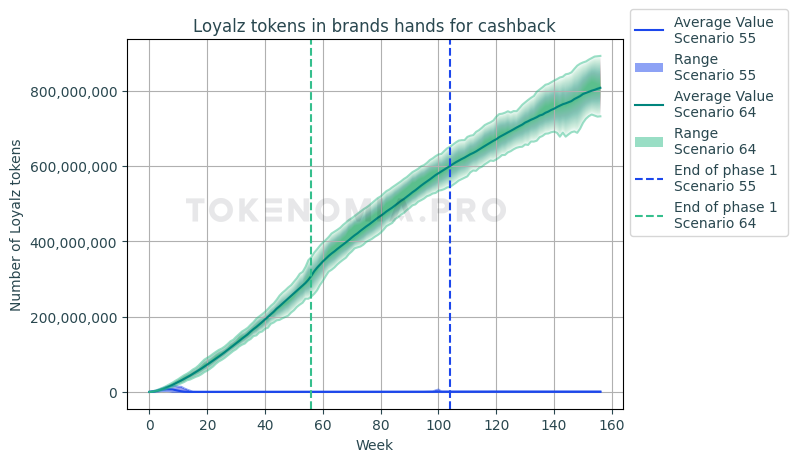

Tokenomia.pro Solution: On top of the model we created and through hundreds of simulations, we identified threats and provided recommendations. In most scenarios, the staking reward pool exhibits an upward trend.

Effect: The main threat to the cashback program was a significant disparity between the number of customers using the cashback program and the number of NFT collection sales. Such a scenario results in the complete depletion of the token pool for cashback in the hands of the brand. Therefore, a proposal was put forward. It suggested that customers who have not purchased any NFT tokens receive a much lower cashback.

Check how we can help you with your Web 2.5 project: https://tokenomia.pro/blockchain-consulting/

Process Behind

We are using a proven process that consists of 3 main stages: System Discovery, System Model, and System Validation.

System Discovery: We deeply explore and understand every aspect of the system, carefully examining its needs and how each component connects and interacts. This process results in a detailed specification that not only guides the economic setup and token system design but also provides a clear roadmap for project leaders and advisors, outlining the goals, key components, functionality, and growth stages of the system.

System Model: We utilize advanced simulation tools to build a dynamic model based on the initial phase’s specifications, primarily using Python and the cadCAD/radCAD framework. This model allows us to simulate various scenarios, providing a foundation for crucial project decisions and ongoing adaptation, ensuring our strategies remain effective and responsive to the evolving environment.

System Validation: We validate initial assumptions of the project through comprehensive system analysis, encompassing simulations of user numbers, resource dynamics, and fluctuations in both cryptocurrency and traditional business elements. This phase involves rigorous testing in hundreds of scenarios to assess the system’s response to various internal and external forces, and to identify necessary modifications, ensuring the project’s adaptability to current and future needs, including secondary market behaviors and token issuance strategies.

System Discovery

The following functions were intended to be fulfilled by the system.

- Attracting individuals from Web2 to Web3 solutions.

- Generating profits for both companies and customers.

- Acquiring customers from web3.

- Facilitating the implementation of loyalty programs for small and medium-sized businesses.

We researched existing e-commerce and cashback solutions in web3. We understood the client’s vision and needs. Then, we created a project specification. It is in the form of a Model Design Document. This document describes all system mechanisms and relations between components. It also describes the system’s agents, assets, and internal and external forces.

In particular, we proposed a set of mechanisms described below.

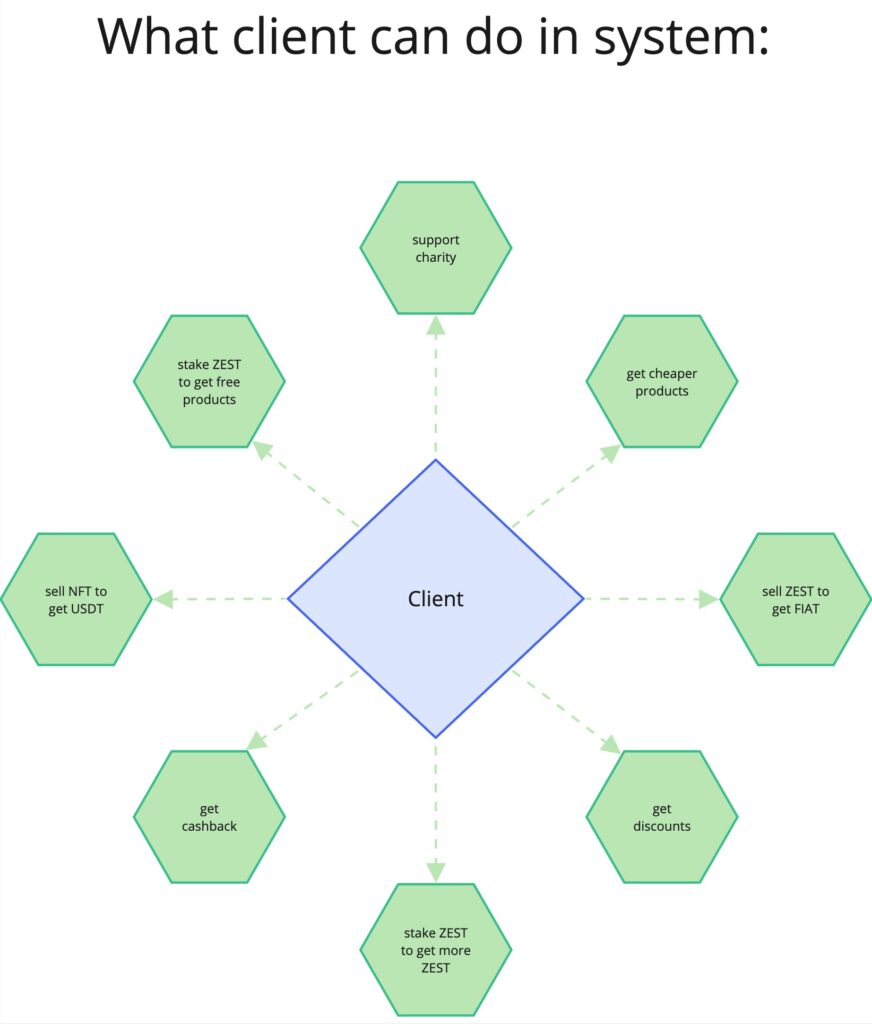

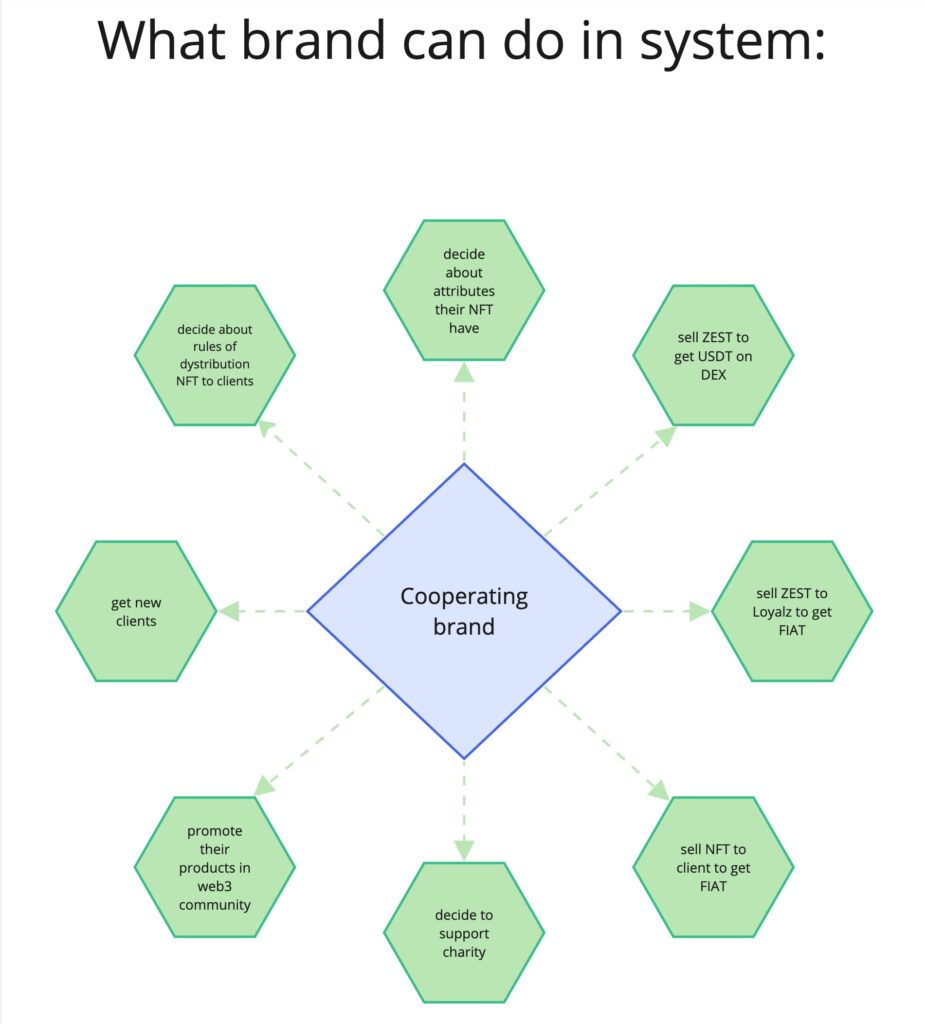

Loyalty program for the brand in the form of original NFT collections:

Brands control NFT collections’ quantity, price, appearance, distribution, and purchasing model. Customers can receive NFT collections for free or pay for them (in Loyalz or FIAT). Whether customers can get NFT collections depends on specific conditions. NFTs identify loyal customers and give them benefits. Users can also trade NFTs on the secondary market, and the brand gets some of the profits. Brands can donate a part of the profits from every transaction to charity. NFTs can act like loyalty cards and give bonuses for a set or indefinite time.

Loyalz point tokens within their economy:

You can use the token to get brand discounts on products or services. Loyalz tokens are created and given to brands or private investors who buy them before they are listed. Brands get Loyalz tokens when they buy NFT collections. They can sell the tokens on a Decentralized Exchange or Loyalz.io. Customers get Loyalz tokens as cashback. They can use the tokens to buy products or services from brands. You can also pay with both Loyalz and FIAT.

The Loyalz mechanisms include:

- Vesting

In the project’s second phase, private investors can get Loyalz tokens. There are conditions for getting these tokens. These tokens are given slowly to avoid sudden price changes. This happens when too many tokens are sold or used at the same time. Investors can do different things with their Loyalz tokens. They can sell them on DEX, use them to buy brand products or stake them.

- Staking

There are two types of staking in the system. Staking is when users freeze tokens for a set time. The first type gives rewards in Loyalz tokens. The second type gives rewards in services or products from brands.

- Exchange/sale

Users and brands can buy and sell Loyalz on DEX to earn.

Loyalz.io, when needed, can repurchase Loyalz tokens from the brand for FIAT or get them from DEX. Loyalz.io can also repurchase Loyalz tokens for FIAT from charitable organizations. Charitable organizations can also sell Loyalz tokens on DEX. In such cases, Loyalz tokens are either redistributed or burned by Loyalz.io.

- Burning

In the project’s second phase, Loyalz tokens burn to keep their deflationary nature. When people buy services or products from brands using Loyalz, a percentage of the token value goes to the burning pool. Tokens burn during transactions. For example, when selling NFT tokens for Loyalz, buying Loyalz with FIAT from brands and charitable organizations, and on DEX by Loyalz.io.

- Cashback

When users buy a product or service from a brand, they get a certain number of Loyalz tokens as cashback. The tokens are given out later after considering how long users have to return the product.

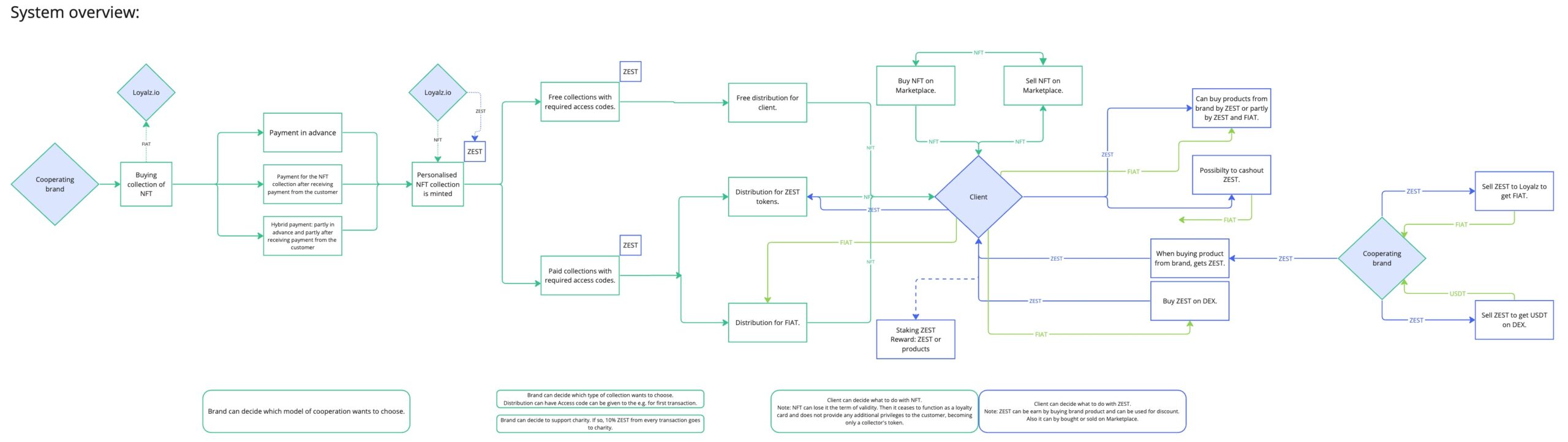

System Overview

- Brands

Companies collaborating with Loyalz.io buy dedicated NFT collections from it. They also buy an associated amount of Loyalz tokens. They reward their customers for purchases in their stores using loyalty cards. The cards come in the form of NFTs and Loyalz points.

- Clients

These are customers of brands that have purchased NFT collections and Loyalz. As a reward for their purchases, they receive NFTs and Loyalz. These entitle them to discounts, cashbacks, free products, or other benefits for their engagement.

- Loyalz.io

Loyalz.io is a company that provides dedicated NFT collections and Loyalz tokens to brands. They also oversee the supply and demand relationship. They influence these mechanisms by acquiring and burning Loyalz to positively impact its price.

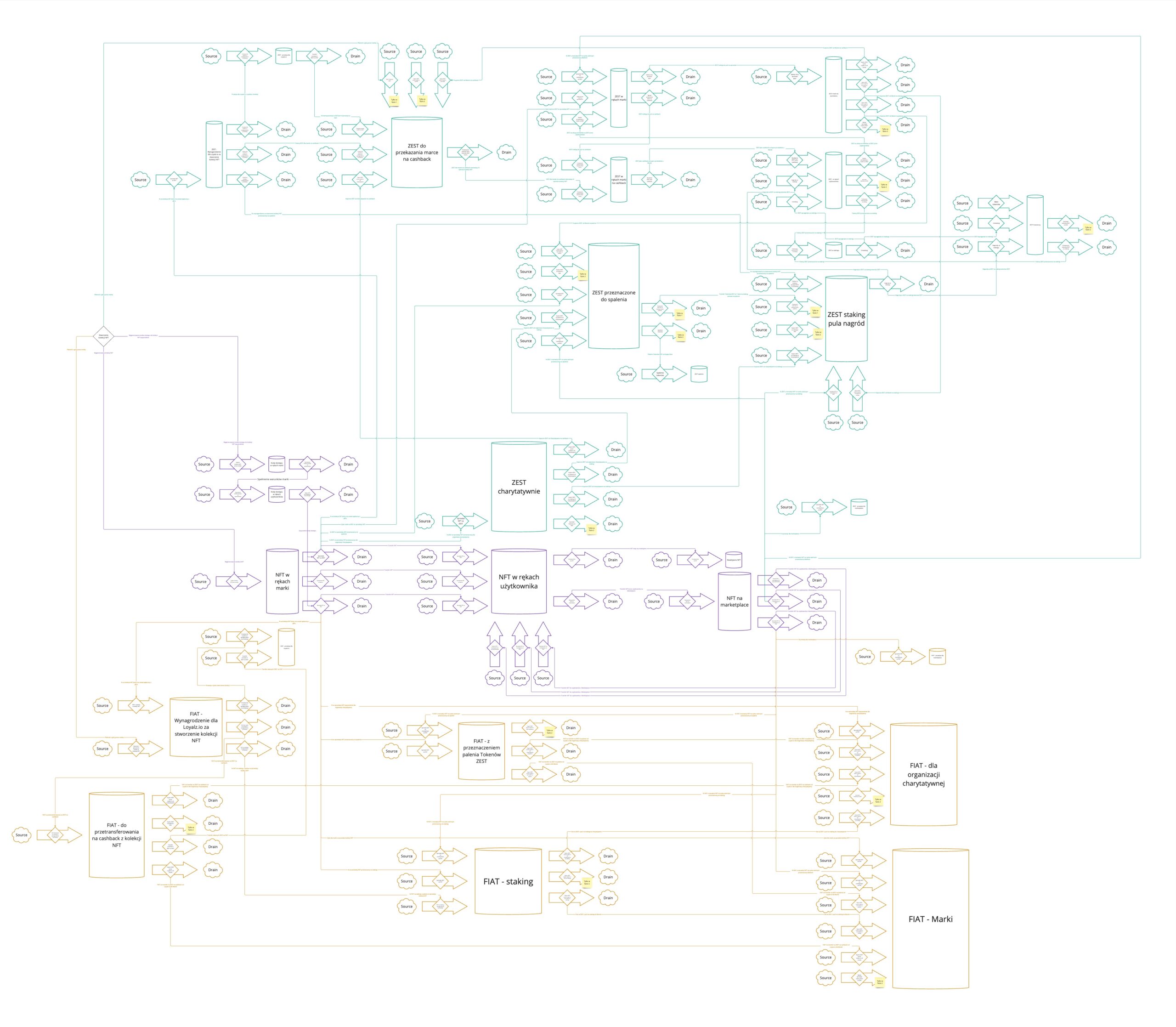

Stock & Flow Diagram

We use Stock & Flow Diagrams because it’s a simple way to picture how a system moves and changes. This diagram is handy because it helps us see how things change over time. For example, if you’re saving money, your savings account is your “stock” of money. Depositing money is a “flow” that increases your savings, and withdrawing money is a “flow” that decreases it.

The main reason to use Stock & Flow Diagrams is to understand complex systems. It’s valuable when you’re dealing with complex situations where things change a lot. By breaking down a system into stocks and flows, you can better understand how different parts affect each other and the whole system.

Mathematical specification

As a next step, we describe all the flows and relationships in the system mathematically. This will ensure that everyone, from business to smart contract engineers, understands how the system will work. It will also help them avoid making wrong assumptions.

Below is an example of a fragment of a mathematical specification provided by Tokenomia.pro, describing a part of the NFT collection distribution mechanism:

[…], the number of NFT tokens received by customers for free depends on the parameters: access_codes_free_nft_collected_percentage, open_free_nft_collected_percentage, and is equal to:

Equation 6: The number of received free NFT tokens in a given simulation step.

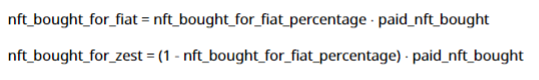

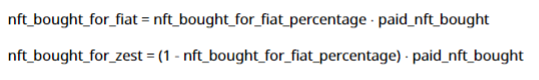

Customers have two payment options: FIAT or Loyalz tokens. The division of the number of NFT tokens into two payment methods is described by the following formulas:

Equation 7: The number of NFT tokens purchased for Loyalz tokens and FIAT.

where

nft_bought_for_fiat_percentage is a parameter determining the percentage of NFT tokens to be purchased for FIAT.

System Model

After completing the project phase and using math, we developed a digital twin of the system. It reflects the entire system.

Part of Differential Specification/ Digital Twin:

This is an example of a fragment of a differential specification. It describes a part of the NFT collection distribution mechanism.

System Validation

The simulations tested the system’s proper functioning. They also tested the impact of external market forces on its stability. We conducted hundreds of scenarios. These simulations obtained a wealth of data in the form of multi-level charts.

In collaboration with Loyalz.io, we conducted two independent analyses:

- Monte Carlo Simulation Analysis.

- Parameters Sweep Analysis.

Below, you can find sample charts

A chart illustrating the price of Loyalz over time and other parameters.

A 3D chart illustrating the price of Loyalz over time and the number of customers.

An interactive chart illustrating the relationship between the price of Loyalz and the number of brand customers.

Analysis of the correlation coefficient of the Loyalz Token.

Conclusion

In the final phase, we analyzed the validated assumptions. This allowed us to propose a series of recommendations. Implementing these recommendations will result in the most optimized and beneficial system.

We did extensive research and had many client meetings to understand their vision. With this knowledge, we translated the project’s essence into a detailed multi-level system. Our innovative approach, expertise, and experience helped us create compatible mechanisms. These include agents, assets, and internal and external forces. We analyzed the project using specialized math and a digital model. We ran hundreds of simulations to explore different parts of the system. We gained important insights, made strategic recommendations, and identified risks.

Let’s talk about Web 2.5

The best first step is to talk to our consultant. During a free consultation, you can check the consultant’s competences and look for initial solutions to the challenge that is currently most important for your project.

Let's Collaborate

Whether you have questions, collaboration ideas, or just want to say hello, we're here and ready to connect. Your inquiries are important to us, and we look forward to engaging in meaningful conversations.