36 minutes read

36 minutes readTable of contents

Decentralized Finance (DeFi) Explained: Revolutionizing the Financial Landscape

Introduction

Web3 is characterized by a wide range of innovations and novel solutions. The concept of decentralization is right now permeating gaming, voting processes, and more. However, it was precisely DeFi that pioneered decentralization and emerged as one of the earliest categories to gain popularity within Web3. For several years, decentralized finance (DeFi) has been at the forefront of attention. Despite carving out a significant place in the Web3 ecosystem, DeFi continues to undergo constant innovation, expansion of activities, optimization, and creativity. Do you know what is Defi? If the term doesn’t ring a bell and you’ve somehow missed this trend, then this article is undoubtedly for you.

In this article, you’ll discover:

- What are the shortcomings of the traditional financial system?

- What is DeFi and how does Blockchain relate to it?

- What are the key characteristics of DeFi?

- What actions can be undertaken within the realm of DeFi?

- What tools does the DeFi sector utilize?

This article aims to introduce the world of DeFi. It will shed light on its importance, potential, and practical uses in the fast-changing world of Web3. Whether you’re a newcomer or a seasoned enthusiast, there’s something valuable to gain from exploring the intricacies of decentralized finance. Let’s dive in!

Examining the Unbanked Population Globally

If you have a credit card in your wallet or a mobile app with bank account on your phone, you’re undoubtedly familiar with the traditional centralized banking system. And if you belong to this group, you should consider yourself fortunate.

“Unbanked” refers to individuals or entities who lack access to traditional banking or similar capital and financial services. It includes people who lack checking, mobile money, or savings accounts and key financial products like insurance, loans, and mortgages.

Even in the United States, a country known for its high development, about 4.5 percent of households were unbanked in 2021. This means no member of the household had a bank or credit union checking or savings account. This figure translates to roughly 5.9 million households across the nation. This underscores the ongoing challenge of achieving financial inclusion, even in advanced economies.

Unbanked households in the US cited many reasons for their lack of accounts. The most common reason in 2021 was not having enough funds to meet minimum balance requirements (21,7%). “Lack of trust in banks” was the second (13,2%) and “Desire for more privacy by avoiding banks” was third (8,4%). Other factors encompass distance to banks, documentation requirements and religious considerations.

Source: https://www.fdic.gov/analysis/household-survey/index.html

This issue also affects developing countries such as Morocco, Vietnam, Egypt, the Philippines, and even Mexico, which still harbors a significant unbanked population as of 2021. Educational attainment emerges as a crucial factor as well. Nearly a fifth (19.2%) of individuals without a high school diploma are unbanked, in stark contrast to only 0.9% of college graduates. Additionally, people with disabilities are much more likely to be unbanked, with the rate being about four times higher than for those without disabilities. Globally, women make up the majority of the unbanked population, facing obstacles such as lack of identification and limited rural access. In 2017, an estimated 980 million women lacked bank accounts, representing 56% of all unbanked adults.

Source: https://borgenproject.org/unbanked-population/ https://gfmag.com/data/worlds-most-unbanked-countries/

We should recognize that participation in a centralized financial system is a privilege. However, economic growth and development are pivotal for empowering individuals both globally and locally. So it’s essential to take real steps to ensure accessibility to financial services for everyone in need. By doing so, countries and their populations can capitalize on opportunities for advancement. It is obvious that some may advocate for expanding the roles of traditional financial institutions as a solution to this issue. But before reaching conclusions, they should get to know the content of this article.

Challenges in centralized financial institutions

Classical finance embodies a complex terrain, characterized by both strengths and weaknesses. Widely known and participated in by most individuals, it is praised for its ability to offer stability and predictability. This is especially true for long-term stock returns and the reversion of cumulative returns to trend. Moreover, it boasts a well-developed infrastructure. However despite the prevalence of centralized financial institutions globally, substantial accessibility gaps remain. Apart from limited access, there is much more…

Centralized control

Centralized control is a big problem in banking because large banks and central national banks have a lot of power over money. But this setup can lead to issues like fraud and unfair lending. Plus, bosses at these banks often make all the decisions, leaving employees little room to do things differently.

Lack of transparency

Banks aren’t always clear about how they do things. Transactions and services often seem biased, with some people getting better deals than others for no clear reason. This lack of transparency can make it hard for people to trust banks.

Inefficient

Traditional banks are inefficient and overloaded. Their outdated infrastructure and the sheer number of employees involved in processing larger transactions slow down all processes. That’s why transactions can take forever to process. This is especially true for significant payments or those involving international transfers. Even simple tasks like transferring money between accounts can take ages. This can be extremely frustrating, especially when we’re accustomed to everything happening quickly.

Unreliable

Instances of bank failures, resulting in customers losing their entire savings, are not unheard of. Furthermore, inflation reveals its susceptibility to fluctuations and its struggle to maintain the value of money.

Outdated

Despite the sophistication of the classical financial system in ancient Rome, it did not undergo a transformative financial revolution akin to the modern banking system. Banks can be slow and outdated. Things like wire transfers and buying stocks can take days to complete. This not only slows down transactions but also gives scammers more opportunities to trick people.

Lack of Innovation

Traditional finance is limited, with few new tools and innovations. Every bank does the same thing, copying solutions from others while relying on years-old technologies. There’s no room for creativity; the barrier to entry with new solutions is high; it’s closed and boring. This system proves inefficient in keeping pace with rapid technological advancements.

Bureaucracy

When attempting to open an account or, especially, when needing a loan instantly, we’re entangled in bureaucracy. We need to provide a plethora of papers, certificates, private, and sensitive information. The whole process drags on for weeks.

Unfair

Having money in a savings account, our bank or another entity manages it to make it work. However, we receive profits in the same amount regardless of the actual gains our money made. The managing entity profits the most from our money due to the lack of fair distribution and transparency. We don’t even know how much we’re losing.

As we can see, traditional finance is characterized by inefficiency, outdated solutions, and a lack of innovation, coupled with bureaucracy. These are the result of a reluctance to embrace new approaches, despite the fact that technological advancements allow us to easily address these challenges. Centralized control, lack of transparency, and, consequently, unreliability and unfairness are inherent problems in this system’s mentality. The underlying ideas do not promote equality and transparency; rather, they place significant emphasis on the traditional approach, where only the qualified and privileged have access to information and power.

What is DeFi?

The concept of DeFi represents a revolutionary shift towards democratizing access to financial services. Similar to other Web3 technologies like DAOs or GameFi, blockchain empowers users by putting more control in their hands. This is a significant technological evolution where, as a highly interconnected species, we can assert our autonomy and agency. The ability to observe the actions of structures, projects, and applications represented transparently by DeFi systems, aims to dismantle the power monopoly of financial elites. Moreover, it provides secure, decentralized access for ordinary people.

Finance encompasses the infrastructure of the financial industry, including various systems and processes. When discussing whether a financial system is centralized or decentralized manner, we refer to its foundational structure. Centralized finance is considered outdated and rife with manipulation. It has operated the same way for decades. It is marked by high fees, inefficiencies, deception, fraud, and corruption and also by issues such as inflation, currency devaluation, and banking crises.

On the other hand, decentralized finance (DeFi) represents a paradigm shift in the global financial industry. It offers a low-cost, fast, efficient, trustworthy, and transparent alternative to centralized finance. From the perspective of creators, there is ample room for creativity and innovation in project development. While for users, DeFi prioritizes convenience and accessibility, making it highly accessible to anyone with a smartphone and an internet connection. Importantly, DeFi operates without a central authority, allowing for more freedom and democratization of financial services.

The Evolution and Impact of Decentralized Finance- DeFi

Bitcoin began the decentralized revolution, by providing technology that enables the transfer and storage of funds without central control. Ethereum, as the first smart-contract blockchain, expanded on this idea by introducing the capability to program services through smart contracts, often portraying DeFi as programmable money.

Definition: Smart contracts are self-executing contracts with the terms of the agreement directly written into code. This allows for automated and trustless agreement execution. It eliminates the need for intermediaries.

DeFi, short for Decentralized Finance, is a revolutionary shift in financial services. By using blockchain instead of traditional banks, it democratizes finance by enabling peer-to-peer interactions across various activities like banking, lending, and trading. By removing third party involvement, Blockchain network gives users possibility to access capital and financial services directly, revolutionizing traditional functions like banking and insurance. It leverages public blockchains for global coordination without relying on centralized authorities, challenging conventional financial systems.

Definition: Peer-to-peer (P2P) is a decentralized interaction between two or more participants in a network. Each of them can act as both a client and a server. It allows direct exchange of resources, data, or services without intermediaries or central authorities.

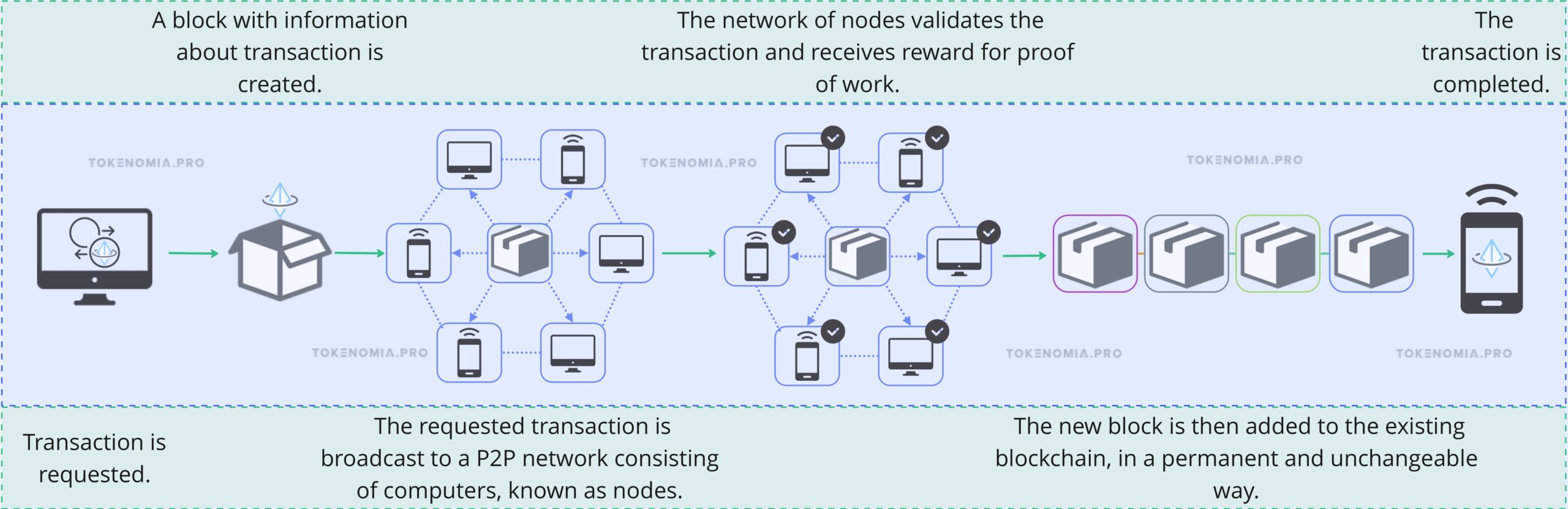

At the heart of DeFi lies blockchain technology, serving as its foundation. This technology ensures the integrity of data by locking it into unchangeable blocks. These blocks are distributed across a global network of computers, making tampering with data extremely difficult. Additionally, the data within these blocks is encrypted, further enhancing security and privacy. The decentralized nature of blockchain technology promotes transparency, which aligns well with DeFi’s decentralized structure. In a blockchain, transactions are recorded and verified in blocks through automated processes. Once verified, the block is closed and encrypted, creating a new block that includes information from the previous one. These blocks are linked together, forming a chain. Information in previous blocks cannot be changed without affecting the following blocks, so there is no way to alter a blockchain. This concept, along with other security protocols, provides the secure nature of a blockchain.

Using applications called wallets, individuals hold private keys to tokens or cryptocurrencies, functioning like passwords. These keys grant access to virtual tokens that represent value. Ownership of the tokens is transferred by sending an amount to another entity through a wallet, which then generates a new private key for the recipient. This process secures their ownership of the tokens, and the blockchain design ensures that the transfer cannot be reversed.

Blockchain utility

The utilization of blockchain network underpins the functioning of DeFi applications. Unlike traditional banking systems where transactions are recorded in private ledgers managed by centralized institutions, blockchain operates as a decentralized and distributed public ledger. This means that every participant in a decentralized finance ecosystem has an identical copy of the ledger. It contains records of all transactions encoded securely. This distributed nature ensures anonymity for users, while simultaneously offering robust verification mechanisms and immutable records of asset ownership, which are highly resistant to fraudulent activities.

Decentralization of blockchain removes the need for middlemen in verifying and recording transactions. Transactions within the DeFi enviroment are verified and recorded by network participants through a consensus mechanism. It often involves complex mathematical computations to add new blocks of transactions to the blockchain. This decentralized approach promotes transparency, and enhances security. This contrasts sharply with the opaque and centralized systems common in traditional finance.

In essence, DeFi transforms closed financial systems into open economies. By use of open-source protocols it makes financial services more accessible, transparent, and efficient. It empowers individuals by enabling them to validate transactions, transact directly with each other, removing barriers imposed by centralized institutions and fostering a more inclusive financial ecosystem.

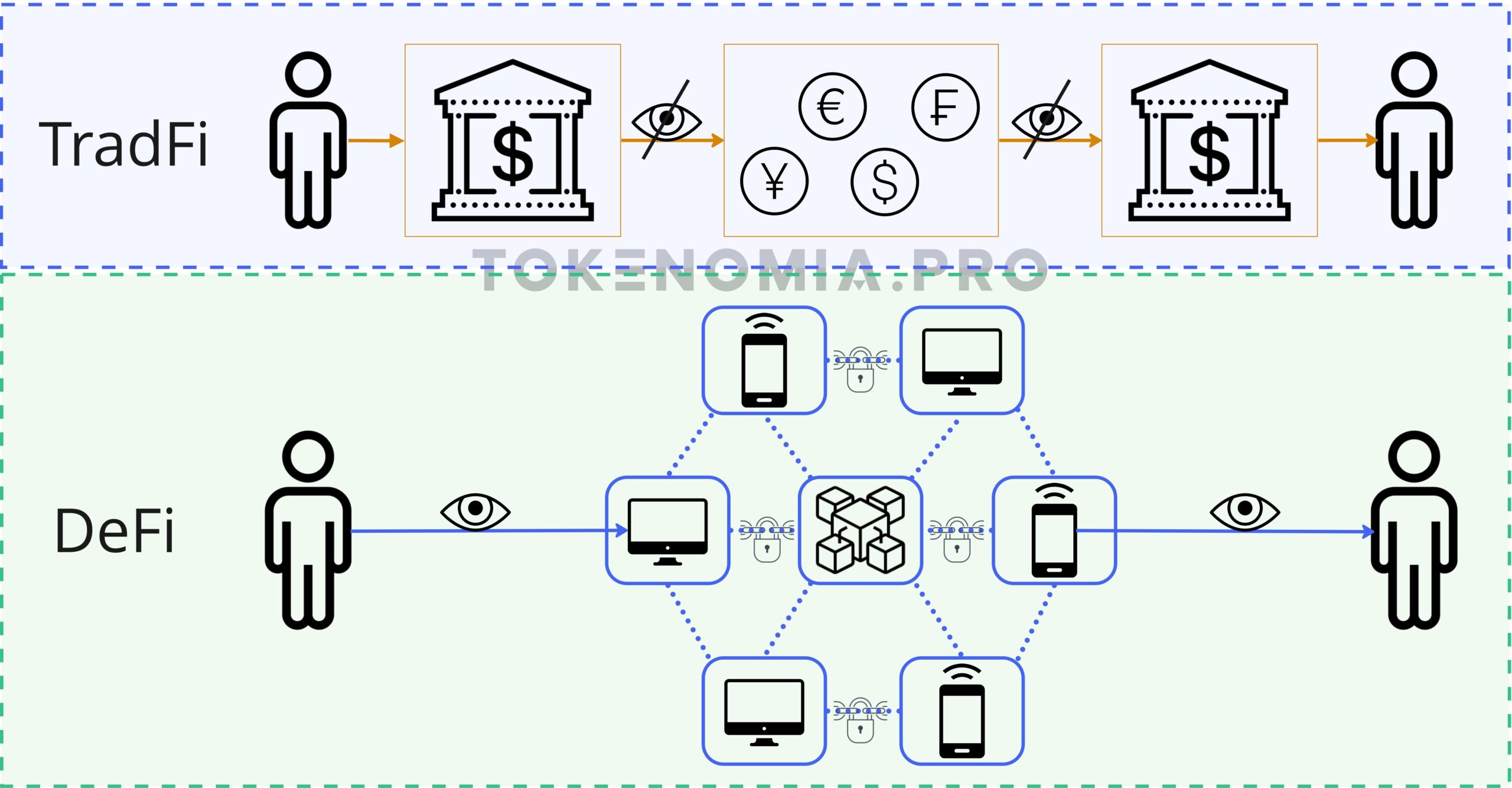

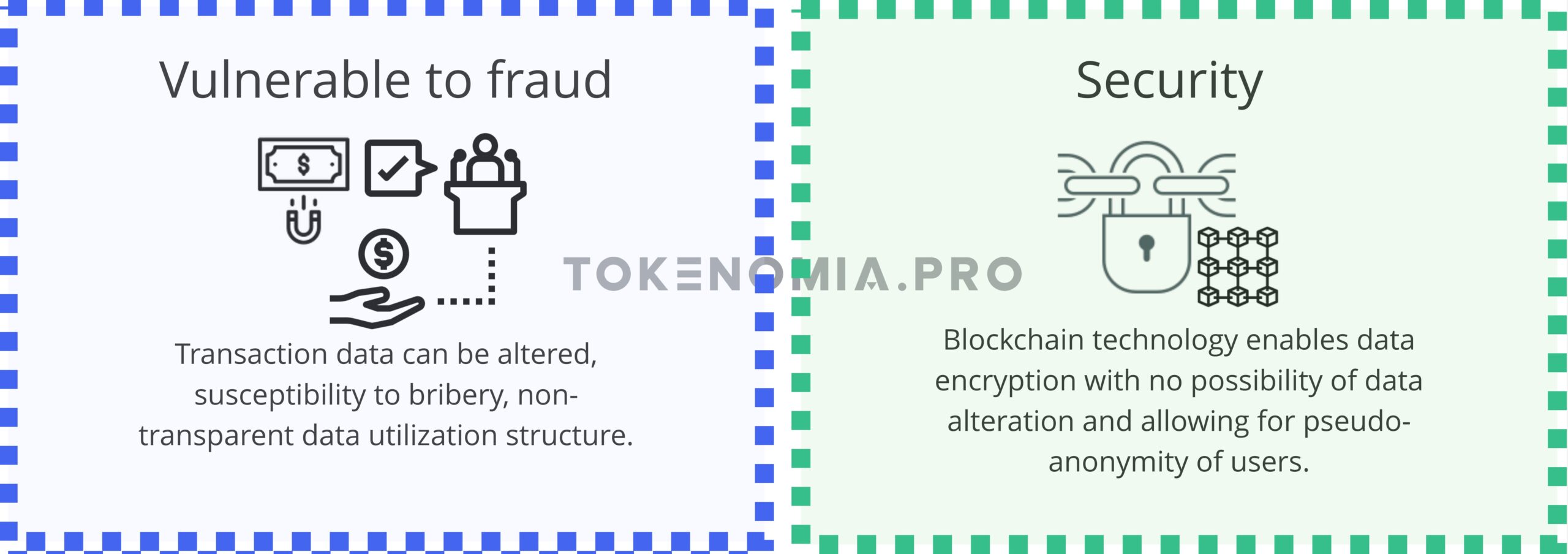

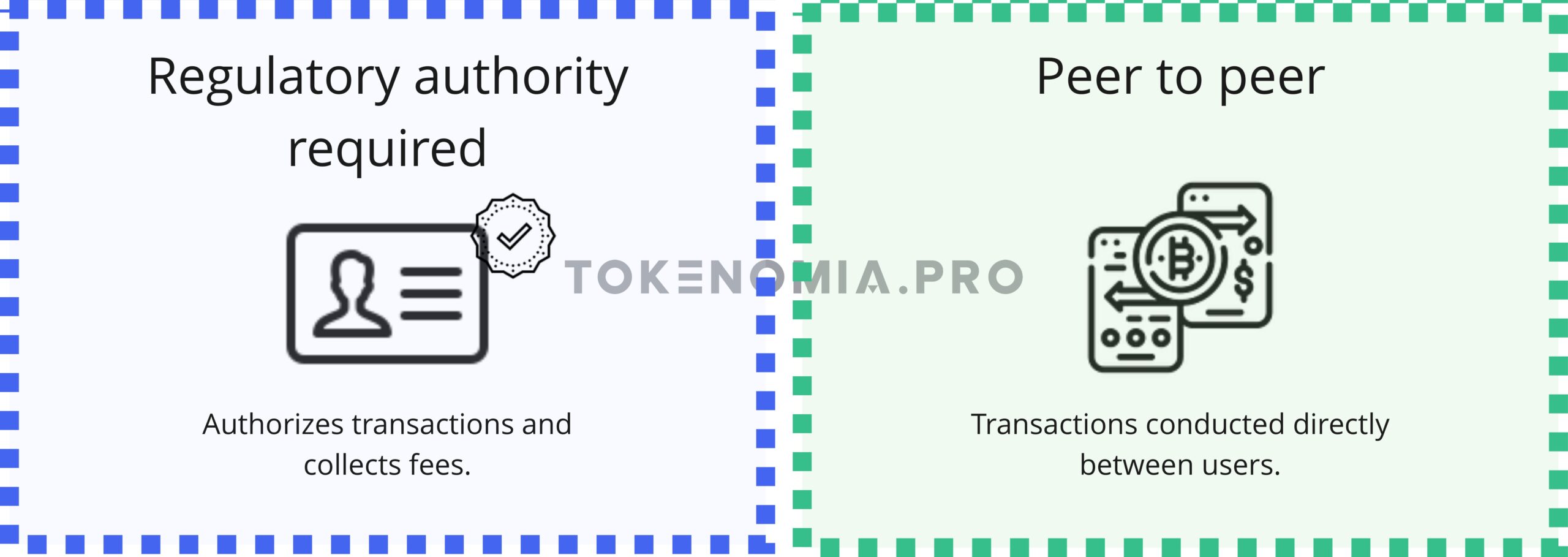

Comparing DeFi and TradFi

As presented above, blockchain technology utilized in DeFi addresses many problems of the traditional system. Below is a comparison of specific attributes of these two solutions.

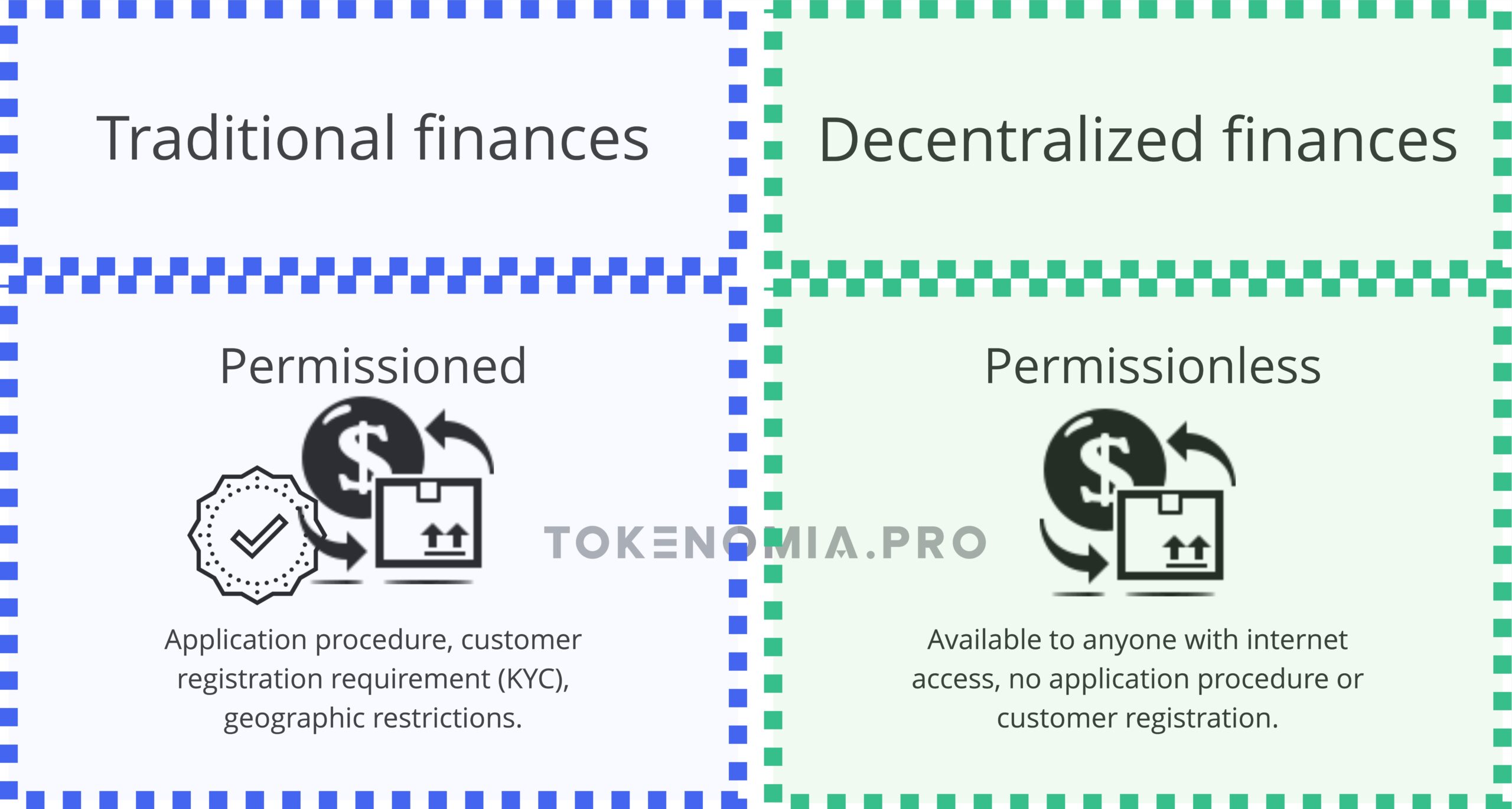

Permissionless

Decentralized finance doesn’t require approval from any regulatory body to join the system or conduct transactions because there isn’t one. Users join the system by connecting to the internet. They don’t need to submit forms or register. They also aren’t subject to any geographical limits.

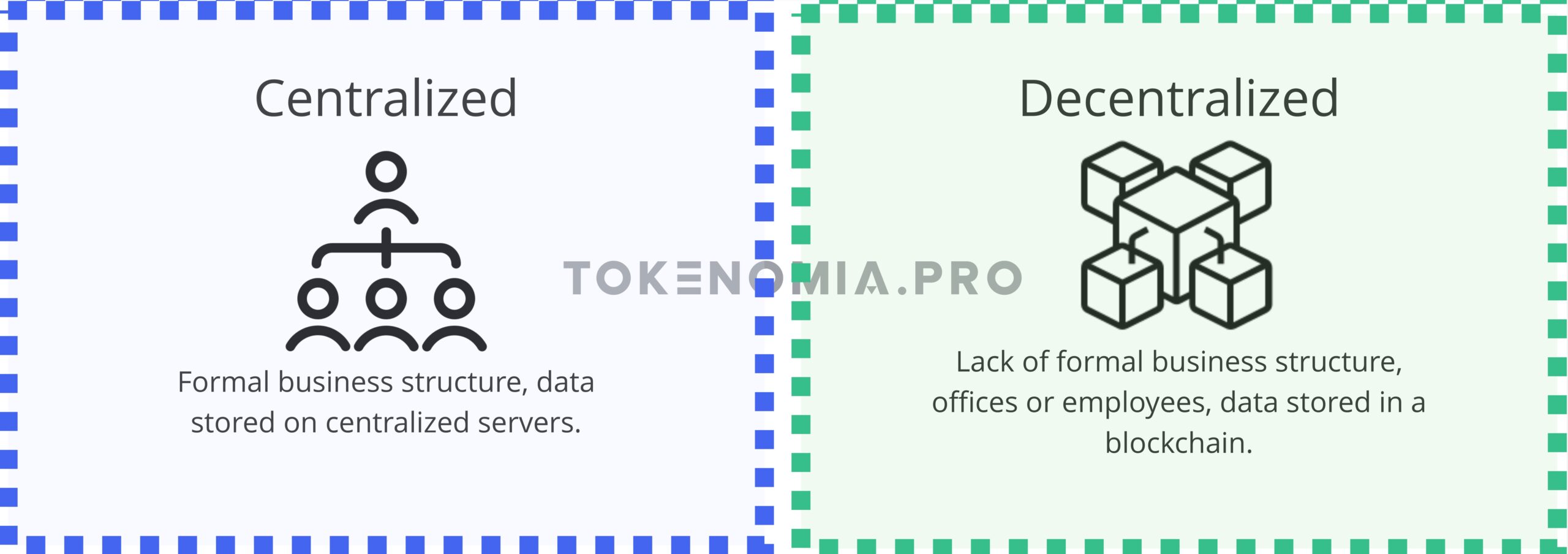

Decentralization

DeFi enables a decentralized structure. No single entity or authority oversees or dominates others. All decisions are made with community consensus. Data is stored in an encrypted and distributed manner. Also, the maintenance costs of infrastructure are much lower. This is because there’s no need for physical infrastructure or employees.

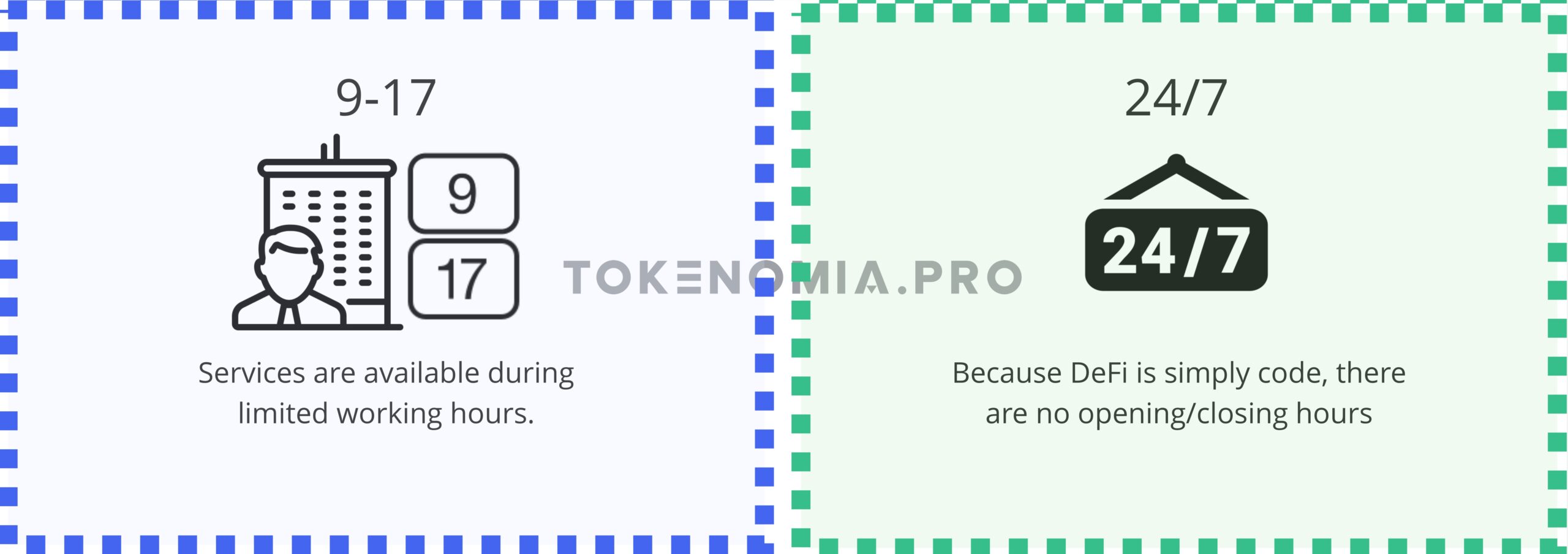

Availability

DeFi services are available 24/7, independent of geographic location. A significant portion of work is automated through the operation of smart contracts and blockchain. Also, in case of an emergency situation like political tensions, TradFi can block all services and freeze the financial resources inside, and DeFi is resilient to such things.

Security

Through centralized data management, traditional systems allow for possibilities of fraud, forgery, and bribery. The outdated security systems of the traditional system are vulnerable to hacker attacks. Blockchain is one of the safest data encryption systems. Thanks to continuous comparison of previous steps with current ones and distributing this encoded information across multiple devices simultaneously, is enabling secure storage and operation of data.

Transparency

In TradFi, most data is only accessible to higher-ranking employees who decide and manage transactions. In DeFi, sovereignty and transparency are handed over to all participants of the network. Recorded transactions are visible to everyone, fostering transparency and accountability.

Directness

In TradFi, a regulatory authority verifies and authorizes transactions, identifying the entities involved. Based on this, it can approve or reject transactions—collecting fees and profiting from participants in the system. In DeFi, transactions occur directly between parties.

In the DeFi landscape, there are some drawbacks as well. First, laws are unclear. They do not cover cross-border transactions and enforcement. This can create uncertainty for participants. Secondly, the open nature of DeFi puts all the responsibility on users. They must pay careful attention to wallet security and transaction verification. Additionally, the absence of consumer protections in DeFi exposes users to potential transaction disputes, heightening the need for vigilance.

Challenges in both TradFi and DeFi stem from various sources. DeFi operates in an unregulated environment, leaving it vulnerable to programming errors, hacks, and scams. At the same time, traditional finances are burdened with the risk of hacking, theft, and financial fraud.

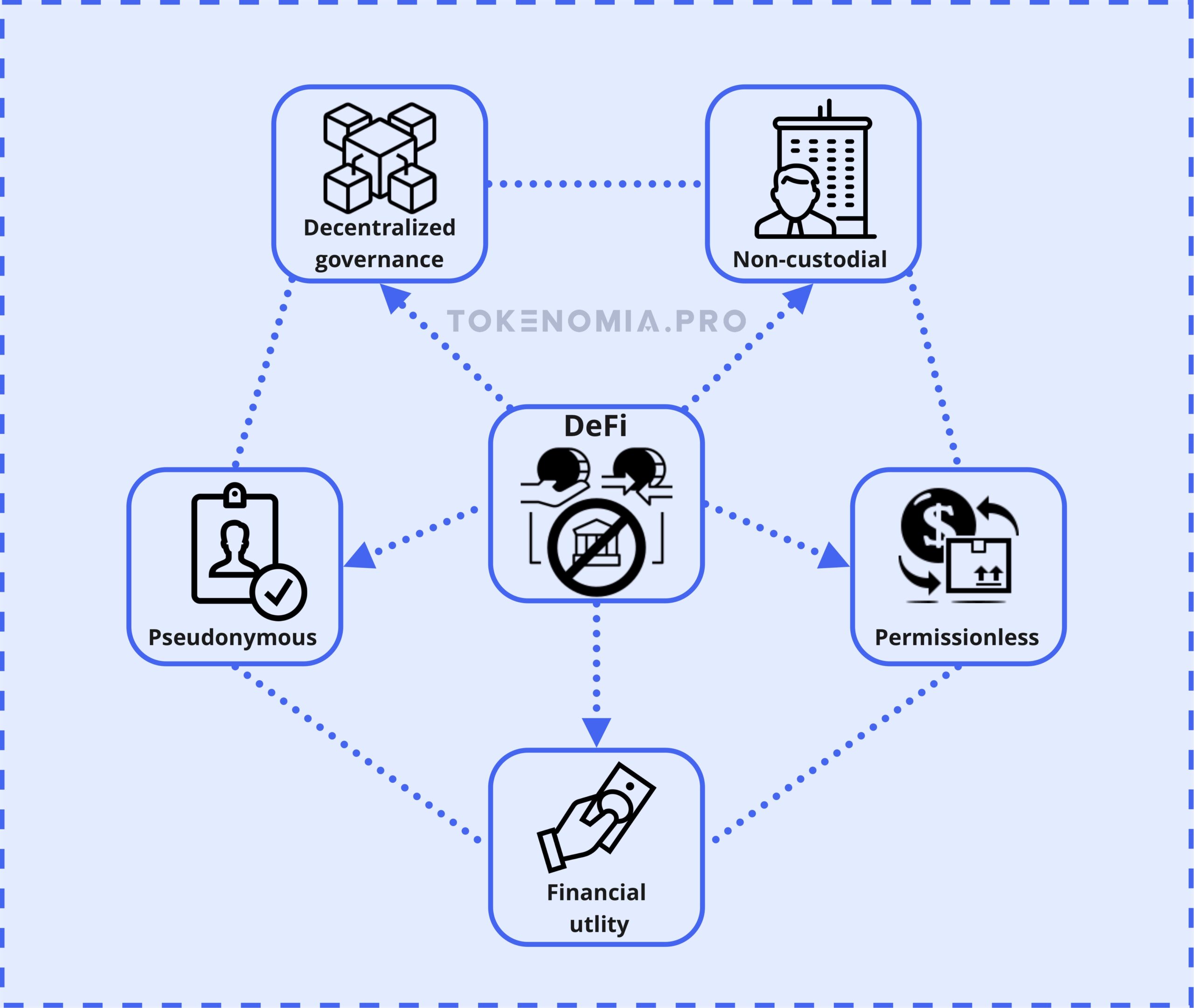

Essential Characteristics

As Decentralized Finance continues its meteoric rise, it becomes increasingly important to establish clear guidelines on distinguishing DeFi tools. Messari, a leading authority in the field, has outlined five criteria for delineating the DeFi ecosystem. These criteria encapsulate the fundamental pillars upon which decentralized financial assets are built.

Financial Use Case Orientation

At the heart of any DeFi token lies its purpose in the financial realm. It has to be linked to financial applications, ranging from credit markets and token exchanges to derivative/synthetic asset issuance or exchange, asset management, and prediction markets. This criterion ensures that DeFi tokens are not merely speculative instruments but actively contribute to the functioning of decentralized financial systems.

Permissionless Nature

The openness and accessibility is crucial for DeFi. Therefore, any token aspiring to be classified as part of this ecosystem must embrace a permissionless ethos. This means the token’s code should be open-source. Anyone can inspect, use, or build upon it without needing approval from a central authority. Such inclusivity fosters innovation and democratizes access to financial services.

Pseudonymity for User Privacy

Preserving user privacy is paramount in the decentralized landscape. DeFi tokens should facilitate transactions without needing the disclosure of users’ identities. This pseudonymity empowers people. They can engage in financial activities securely and confidentially. They can do so without fear of undue surveillance or intrusion into their personal information.

Non-Custodial Framework

Central to the ethos of decentralization is the concept of self-sovereignty. Accordingly, DeFi tokens must adhere to a non-custodial model, where users retain control over their assets at all times. Unlike in centralized finance sector, where assets are often entrusted to centralized intermediaries, DeFi ensures that users have full ownership and control over their funds. It eliminates the risks associated with third-party custodianship.

Decentralized Governance Mechanisms

Finally, decentralized governance forms the base of DeFi ecosystems. Governance should ensure that processes are distributed among network participants. They should not be consolidated within a single entity. Alternatively, there must be mechanisms in place to transition towards decentralized governance if centralized control exists initially. This democratized approach to governance attract users, fosters community involvement, enhances transparency, and guards against the concentration of power.

Source: https://messari.io/article/messari-methodology-what-constitutes-a-defi-token

Thus, services and projects aspiring to adhere to the DeFi philosophy should not only possess genuine financial utility but also aim to reduce reliance on intermediaries and centralized entities. This entails being permissionless, meaning accessible to all without requiring approval, non-custodial, where users retain control over their assets without entrusting them to third parties, and employing decentralized governance, ensuring decision-making power is distributed among participants rather than concentrated in a central authority. Moreover, to safeguard the security and privacy of users, projects should prioritize providing pseudonymity, allowing users to maintain anonymity while engaging in transactions.

Activities in the DeFi Ecosystem

In finance, DeFi projects enable the same activities as traditional systems. But, they do so on their own decentralized terms. They either extend the possibilities of traditional finance (tradFi) or create entirely new avenues, offering innovative solutions to longstanding challenges in the financial sector.

Earning interest

Pivotal opportunity provided by DeFi is to earn interest, combined with passive income.

Staking: In the Web3 world, you can earn additional capital through DeFi staking platform. This involves locking up your funds (staking) for some period of time, after which they are unlocked and staking rewards are accrued. Staking provides greater assurance to project creators that the token value won’t drop so fast, at least during the staking period. Additionally, stakers often receive rewards in the form of airdrops, exposure to the project, or membership in an exclusive community.

Depositing: By depositing cryptocurrencies into DeFi platform, where they’re utilized for activities like lending or trading, users can earn passive income by receive interest payments, which varies depending on the asset. Interest rates may fluctuate based on token demand, supply, and the DeFi protocol’s policies. Some platforms offer fixed returns, while others adjust rates based on market conditions. This method allows users to generate extra income effortlessly. Additionally, DeFi’s decentralized nature grants users greater control over their funds and mitigates risks associated with TradFi.

Yield harvesting: It is also known as the “rocket fuel” of crypto in DeFi. It lets speculative investors earn rewards by lending cryptocurrencies to pools. Within DeFi, investors actively engage in lending, liquidity provision, or collateral offering to maximize returns. This process requires ongoing analysis and management. Investors lend cryptocurrencies on borrowing platforms and receive proprietary coins as rewards, especially valuable when their value rises rapidly, leading to substantial returns.

Money markets – lending and borrowing

In decentralized finance (DeFi), lending and borrowing let people borrow or lend money to grow their capital. This is much like in traditional markets. However, one of the key advantages of DeFi money markets is the absence of credit scores or user history. It ensures user privacy and accessibility. In traditional finance, you must show you are creditworthy to apply for a loan. This involves providing lots of documents, like bank statements and employment histories. Then, you often wait for weeks for a decision. In Web3, this process is significantly streamlined. In DeFi, the aim is to make the process more efficient and fair through transparency and automation.

Below are some popular models. But, DeFi’s creativity and openness to innovation continue to bring newer solutions for lending.

Direct model:

This model involves borrowers directly obtaining loans from lenders, using their cryptocurrency holdings as collateral. It allows for a peer-to-peer transaction between the borrower and lender without the need for intermediaries.

Pool-based:

In this model, borrowers access loans from a pool of funds, with their cryptocurrency holdings serving as collateral. It can therefore be conceptualized as a “peer-to-pool-to-peer” lending market. This approach aggregates funds from multiple sources, providing borrowers with access to larger loan amounts. In the liquidity pool model, lenders contribute their funds to a lending pool. Borrowers can then get loans from this pool at clear interest rates. These rates are set by supply and demand forces. This transparent model ensures that anyone can monitor the amounts of loans issued from a lending pool, guaranteeing overcollateralization to maintain liquidity.

Flash loans:

Flash loans represent a unique concept where borrowers can obtain and repay loans within a single transaction, all without the need for collateral. These loans are granted for very short periods of time. If the borrower fails to execute the transaction profitably, the loan automatically reverts to the lender. Flash loans are popular for decentralized arbitrage. They let users exploit price gaps across platforms without needing much capital upfront.

Collateralized Debt Positions (CDPs) are utilized to secure loans, with borrowers depositing a specific quantity of cryptocurrency assets to obtain additional funds. A CDP operates by locking your cryptocurrency assets within a smart contract. Subsequently, the smart contract extends a loan to you in the form of stablecoins. Upon repayment of the loan, your collateral is released and returned to you. However, if the value of the deposited cryptocurrency drops below the borrowed amount, it might be automatically liquidated to settle the loan.

Decentralized insurance

Decentralized insurance is similar to traditional insurance, but thanks to their implementation on smart contracts, they are less prone to errors. Smart contracts are programmed with a set of parameters that must be met for the insurance to be payout. This happens automatically upon meeting the specified conditions. As a result, funds are allocated without delay, claims are paid out automatically, and there are more effective methods for managing risk.

These insurance policies operate on blockchain platforms. They offer coverage for losses caused by smart contract malfunctions or exploitation. Moreover, insurance policies provide protection against exchange hacks, bugs, and glitches. They foster user confidence in the safety of their crypto assets. You can also insure against the loss of value of stablecoins or secure your funds from further losses in certain projects. With the emergence of decentralized finance (DeFi) and the growing complexity of smart contracts, the demand for reliable insurance against potential failures has become increasingly evident.

Prediction markets

Prediction markets are unique platforms facilitating trading on the outcomes of various events, from sports games to political elections, including crypto and stock price forecasts. These markets harness the wisdom of the crowd, where prices reflect the collective consensus on event probabilities. Decentralized prediction markets are different from centralized ones. They are built on public blockchains, so no single authority controls them. This setup makes them more flexible, secure, and resistant to censorship. They offer advantages such as minimal fees, accessibility for all to trade assets and create markets, and the removal of the need to trust third parties with fund custody.

In the context of cryptocurrency, additional features such as derivatives, perpetual contracts, and ETP tokens further enhance the functionality and diversity of decentralized prediction markets. Derivatives allow users to speculate on price movements without owning the underlying asset, while perpetual contracts provide continuous trading opportunities without expiration dates. ETP tokens represent ownership in traditional financial instruments, providing exposure to various asset classes within decentralized prediction markets.

Despite limited adoption compared to different DeFi protocols, decentralized prediction markets have big potential for disruption and innovation in the changing world of decentralized finance. They let users bet on diverse events for cryptocurrency rewards. At the same time, they resist content censorship and result manipulation.

The Tools Driving DeFi Innovation

In dynamic decentralized finance, some key elements emerge as the fundamental building blocks. They provide the needed infrastructure for innovation and functionality. Within the DeFi ecosystem, projects serve as versatile tools, each representing a unique set of functionalities aimed at reshaping traditional financial services. Those interconnect to construct the DeFi framework, offering everyone a customizable and decentralized financial experience.

Smart Contracts

At the core of DeFi lie smart contracts, the digital agreements that automate and enforce transactions on the blockchain without the need for intermediaries. They are independent entities with logic that is resistant to manipulation and transparent. These self-executing contracts form the foundation of trustless transactions within DeFi, guaranteeing transparency, security, and efficiency. They also automatically perform actions based on predefined conditions, ensuring their resistance to alteration and enabling various functionalities upon meeting specific criteria. Smart contracts not only execute financial agreements but they facilitate seamless interaction between different decentralized applications, promoting interoperability and broadening the scope of decentralized finance.

Definition: Decentralized Apps (DApps) are applications that run on decentralized networks, ensuring transparency, immutability, and security. They serve various purposes, including financial services. They are used in DeFi to provide lending, trading, borrowing services and asset management without traditional intermediaries.

Wallets

Wallets are digital tools, which function independently of exchanges, granting investors seamless access to a diverse array of assets, ranging from cryptocurrencies to blockchain-based gaming assets. They serve as versatile tools, enabling users to store, manage, and transact various digital assets securely. They can be in digital form (ex. Metamask) or as a physical hardware wallet (ex. Ledger). By leveraging blockchain solutions, these wallets prioritize user privacy and security, empowering individuals to retain full control over their funds and assets. Furthermore, digital wallet facilitate seamless interaction with a burgeoning ecosystem of DeFi protocols and decentralized applications (DApps). They foster more inclusive and innovative finance in the digital economy.

Decentralized exchange

Decentralized exchanges (DEXs) revolutionize how cryptocurrency investors trade. They provide a peer-to-peer marketplace. It operates without the need for intermediaries like banks or currency exchange offices. Unlike centralized exchanges (CEX), which require users to relinquish control over their funds to a third party, DEXs empower users to retain full control over their assets throughout the trading process. By leveraging blockchain technology, DEXs ensure minimal custodial risk and maintain user privacy by allowing direct transactions between individuals. Moreover, DEXs offer benefits such as superior security, and increased control over trading activities.

Stablecoins

Stablecoins are crucial in the cryptocurrency world for their ability to reduce the volatility seen in other cryptocurrencies. They keep a stable value by tying to assets like the U.S. dollar. This tie provides users with reliability for everyday transactions. Stablecoins ensure price stability, making transactions smoother. They mostly come in three types: those backed by fiat currencies, cryptocurrencies, or governed by algorithms. Apart from stabilizing prices, stablecoins offer a fast and secure payment method, acting as a link between crypto and fiat currencies and shielding users from price swings.

Non-fungible tokens

Non-fungible tokens (NFTs) intersect with decentralized finance (DeFi) by transforming typically non-tradable assets like videos or the first tweet on Twitter into tradeable digital assets. This connection enables ownership, exchange, and monetization of digital content without intermediaries. NFTs can also be used in DeFi protocol as collateral or in financial instruments. This expands the range of possibilities in the DeFi ecosystem. Also, trading NFTs can generate income similar to traditional art or be capital location, providing opportunities for locking in value within the DeFi landscape.

Synthetic assets

Synthetic assets, or “synthetics,” copy traditional markets in Web3. They do this by mimicking the value of other assets. They offer customizable exposure to various markets and risk profiles. This is done through options, swaps, and futures contracts. They enable diversified capital allocation, risk hedging, and efficiency within the cryptocurrency ecosystem. They are digital representations of real-world assets used for trading, investing, or hedging purposes. Synthetics facilitate risk management, collateral for borrowing, fractional ownership of assets, and yield farming in the crypto space.

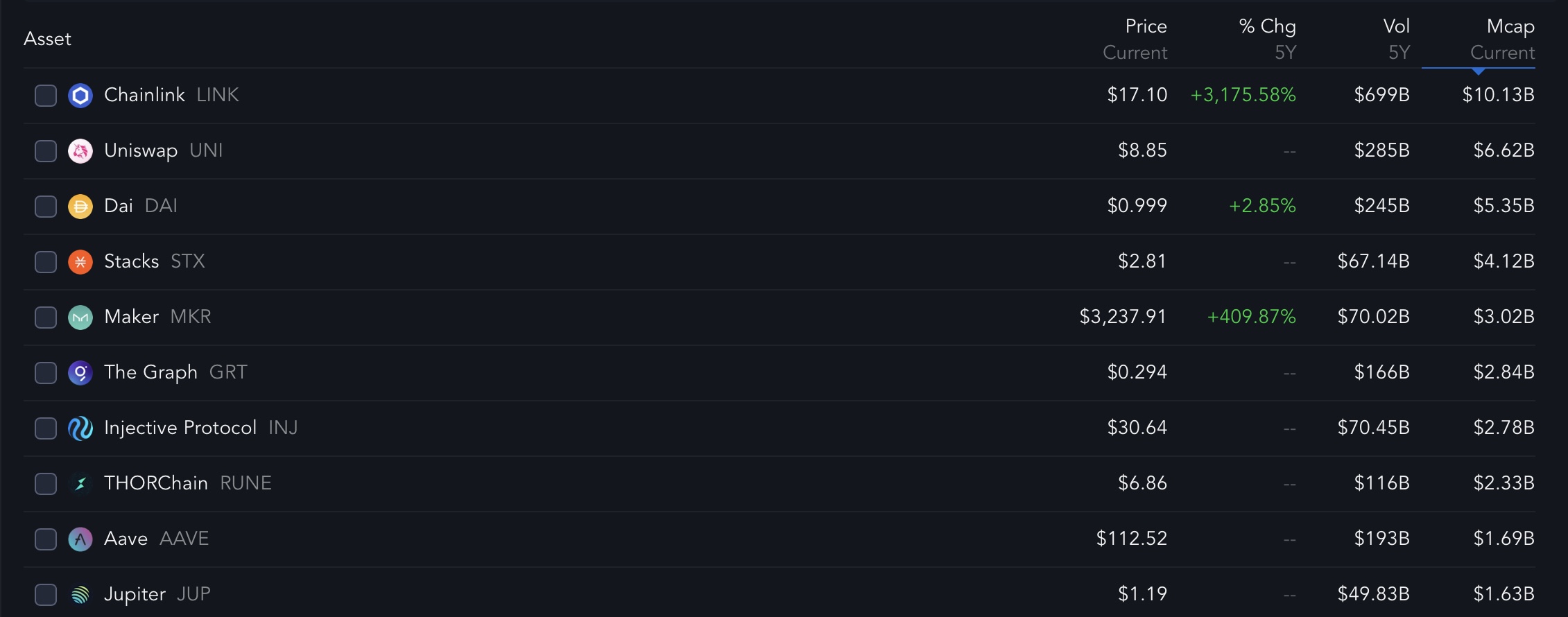

The Rise of DeFi Tools and User Engagement Trends

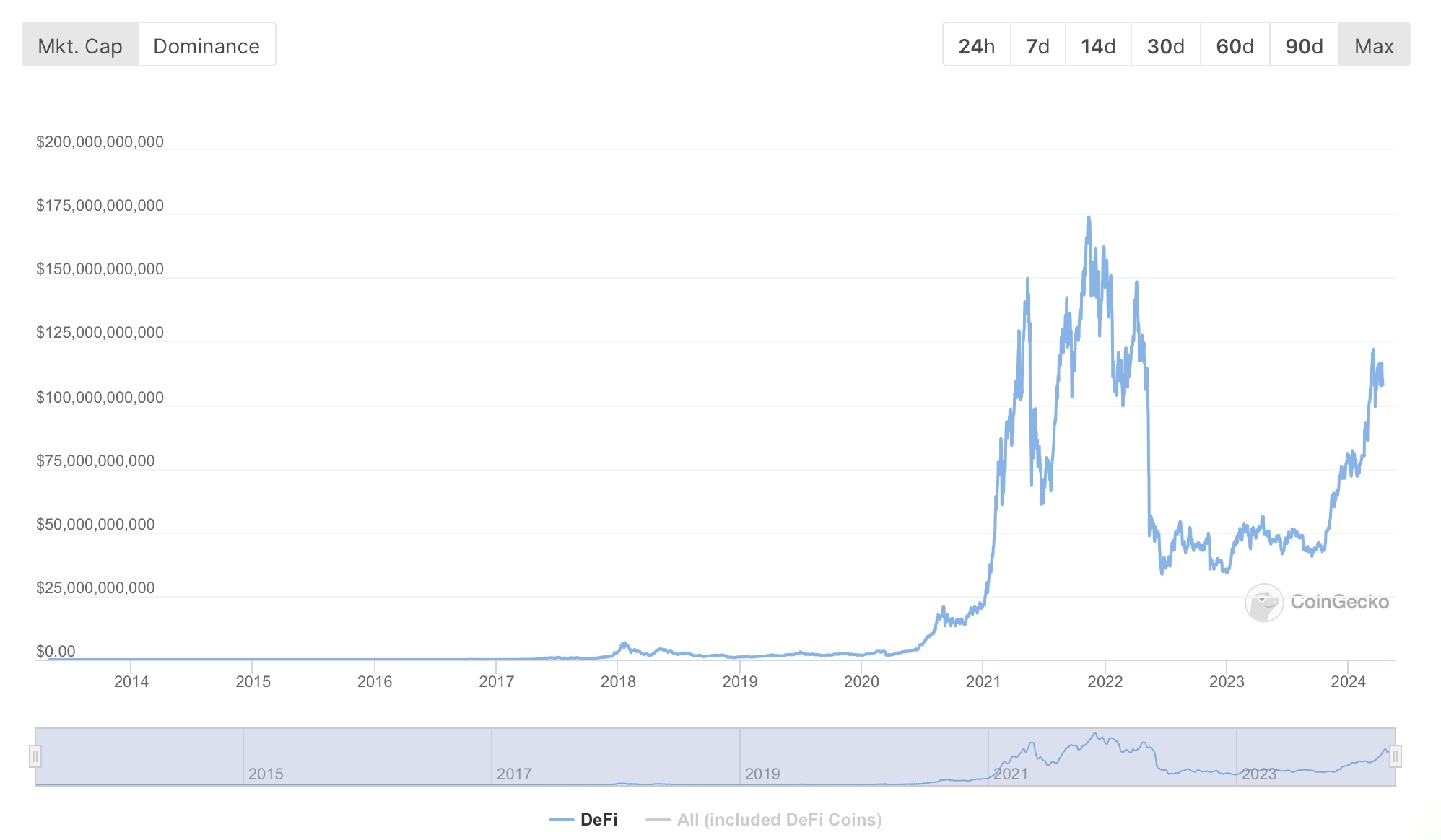

DeFi tools serve as sophisticated financial instruments integrated within diverse projects, offering alternatives to conventional solutions. Their increasing adoption signifies a paradigm shift in finance. Total value locked (TVL) aggregates the capital actively utilized across various DeFi protocols, encompassing staking, lending, pooling, and other financial activities. Coingecko’s data [as of April 2024] reveals a TVL of more than $92 billion dollars.

Market capitalization (market cap) quantifies the collective value of a cryptocurrency’s available units, determined by its current market price. It serves as a pivotal metric in assessing a cryptocurrency’s overall market worth. According to Messari, the top ten DeFi projects have a combined market cap of over $40 billion. Coingecko reports the total DeFi market cap at over $105 billion.

Source: https://messari.io/ [at the time of article writing, April 2024]

Source: https://www.coingecko.com/en/categories/decentralized-finance-defi [at the time of article writing, April 2024]

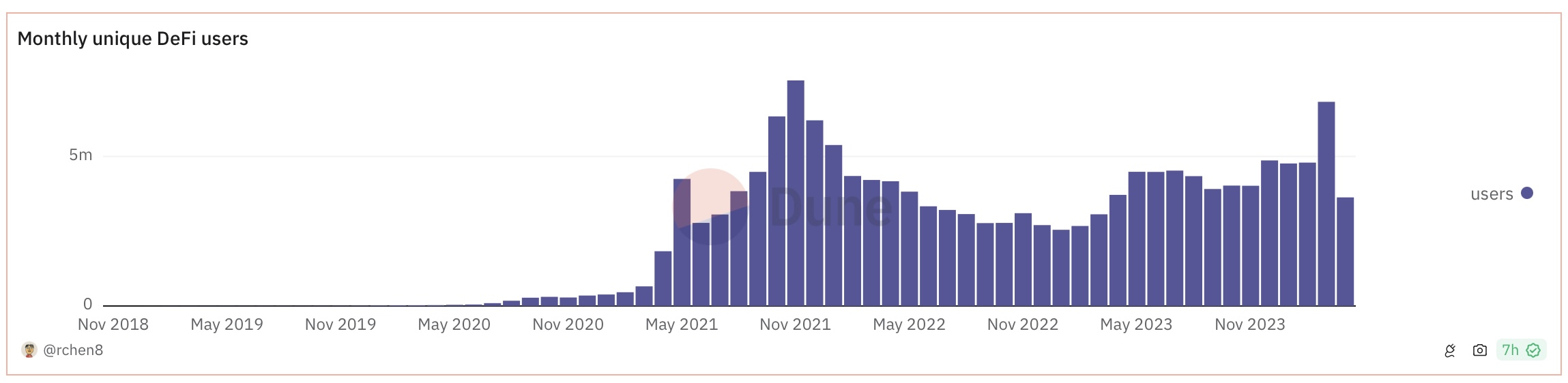

Dune reports that in April 2024, there are over 3.5 million unique users, compared to almost 7 million in the preceding month of March. The peak was in November 2021, surpassing 7.5 million users. It’s evident that user engagement correlates with bullish trends, dips during bearish periods, and currently shows signs of resurgence. This resurgence may be attributed to heightened user activity and the emergence of compelling new projects.

Source: https://dune.com/queries/1760247/2902328 [at the time of article writing, April 2024]

Conclusion – Unlocking Financial Potential in DeFi

Defi represents a sector of immense innovation and new possibilities. Like any emerging technology, it undergoes refinement and grapples with unresolved challenges. However, its resilience and creativity pave a promising path forward. With a diverse array of solutions, tools, platforms, and operational possibilities, DeFi is a sector where everyone can find something for themselves. The varying levels of complexity across these platforms mean that from simple staking tokens to yield harvesting, regardless of one’s familiarity, every participant can discover an offer that intrigues them. DeFi also encompasses various mechanisms, some of which may not fit neatly into predefined categories but serve as financial products that offer opportunities for profit or risk-taking. Considering the data and media buzz surrounding DeFi, it’s a sector with tremendous potential, poised to grow into a formidable competitor to TradFi and undoubtedly offering fantastic alternatives.

What did you learn?

- What are the shortcomings of the traditional financial system?

The problems are: an unbanked population, centralized control, lack of transparency, inefficiency, lack of innovation, outdated systems, bureaucracy, and unfair practices.

- What is DeFi and how does Blockchain relate to it?

Financial decentralization involves removing go-betweens and central authorities from financial transactions. This change enables peer-to-peer interactions and user autonomy. Blockchain technology makes this possible. It provides a clear and secure ledger system. It ensures trustless transactions without the need for banks.

- What are the key characteristics of DeFi?

Financial inclusivity, permissionless nature, pseudonymity for users, non-custodial transactions, and decentralized governance mechanisms.

- What actions can be undertaken within the realm of DeFi?

Earning interest payments, lending, borrowing, insurance, and predictions.

- What tools does the DeFi sector utilize?

Smart contracts, DeFi wallet, decentralized exchanges (DEXs), stablecoins, non-fungible tokens (NFTs), and synthetic assets.

Let's Collaborate

Whether you have questions, collaboration ideas, or just want to say hello, we're here and ready to connect. Your inquiries are important to us, and we look forward to engaging in meaningful conversations.