35 minut czytania

35 minut czytaniaTable of contents

The State of Token Distribution: Low Float High FDV, Airdrops, Memecoins and More

This article is the result of a collaboration involving Tokenomia.pro – Crypto Economy Architects – a company that helps you to design and optimize token economies through modeling and simulations with TokenOps, a leading token operations and lifecycle management platform.

Introduction

If you’ve been in the crypto world long enough, you know that discovering new metas of token distribution is key to unlocking a new cycle. In the fast-evolving crypto market, the way tokens are designed, launched, and managed has seen significant changes. Understanding the practices employed in Web3 to appropriately tailor these elements to your project’s needs is crucial for its success.

One of the recently popular and common strategies is to use a high Fully Diluted Valuation (FDV) combined with a low float token model. Initially, it appeared very promising, but time has shown that this approach is not suitable for every project.

In this article, we will discuss:

- The historical context of popular token distribution trends

- The drawbacks of the current trend of a high Fully Diluted Valuation (FDV) combined with a low float token model

- The key players involved

- Market analysis

- The surprising popularity of memecoins

- Important mechanisms for token distribution

- Better token design strategies

Key Insights:

- The Web3 market is a dynamically changing environment with a range of innovative solutions where each project can find answers tailored to its individual needs.

- Trends in Web3 come and go, so there is no point in following static trends. It is best to tailor important aspects of the project, such as token distribution strategy, to the individual needs and expectations of the project.

- Memecoins are an example of projects where community engagement and marketing are the leading factors, rather than tokenomics.

- Token distribution is influenced by numerous factors and the context in which the project operates. A good practice is to plan mechanisms in advance to adjust the reserve pool accordingly.

- When planning tokenomics and token distribution, it is worth implementing mechanisms that drive the community building process and reduce selling pressure.

Key Concepts in Token Distribution and Economics

To better navigate the complex terms of Web3, it’s beneficial to familiarize ourselves with several specific definitions.

Fully Diluted Valuation (FDV):

FDV represents the total value of all tokens if every possible token were in circulation. It is significant in the crypto market as it showcases the potential market value of a project, often used to attract investment. Traditional tokens’ prices are typically based on expectations of future revenues, value generated by the project, and other fundamental metrics.

Float:

Float refers to the number of tokens that are publicly available and actively traded in the market. The float can influence the liquidity and price volatility of a token.

Low Float:

A low float means that only a small fraction of tokens are available on the market. This creates artificial scarcity and drives up demand and prices, making the tokens appear more valuable, which can lead to greater price volatility.

In the context of token distribution and designing their economics, it is also important to understand concepts such as:

Marketcap (Market Capitalization):

– Definition: The total value of a cryptocurrency’s circulating supply.

– Calculation: Marketcap = Current Price of the Token × Total Number of Tokens in Circulation.

– Example: If a cryptocurrency has 1,000,000 tokens in circulation and each token is priced at $10, the marketcap would be $10,000,000.

Initial Marketcap:

– Definition: The market capitalization of a cryptocurrency at the time of its initial launch or offering.

– Importance: This value gives an initial assessment of the project’s valuation at launch and can indicate investor sentiment and initial liquidity.

Vesting:

– Definition: A process in which tokens are gradually released over a set period, rather than being available all at once.

– Purpose: Ensures long-term commitment from team members and reduces the risk of a large sell-off that could impact the token’s price.

– Example: A project might release 10% of tokens every month over a 10-month period.

Cliff:

– Definition: The initial period in a vesting schedule during which no tokens are released. After the cliff period ends, tokens start to be released according to the vesting schedule.

– Purpose: Often used to ensure contributors or team members remain committed for a minimum period before receiving any tokens.

– Example: A project might have a 6-month cliff, after which tokens start to be released monthly.

Locked Supply:

– Definition: Tokens that are reserved and not available for trading. These tokens are usually held by the project team or are reserved for future use.

– Purpose: Ensures tokens are available for future development, partnerships, or to incentivize team members and stakeholders.

– Example: 50% of the total supply might be locked and scheduled for gradual release over several years.

TGE (Token Generation Event):

– Definition: An event during which new tokens are created and issued. This is the moment when tokens become available to investors for the first time.

– Significance: Marks the official launch of a token and often coincides with the start of trading on exchanges.

– Example: A project might announce its TGE to take place on a specific date, at which point investors can purchase and trade the new tokens.

Staking:

– Definition: The process of locking up a certain amount of cryptocurrency to support the operation of a blockchain network. In return, participants earn rewards.

– Purpose: Helps secure the network, validate transactions, and incentivizes participants. It has a positive effect on the system because it reduces sales pressure.

– Example: Staking Ethereum in the Ethereum 2.0 network to earn rewards over time.

Holding:

– Definition: The act of keeping a cryptocurrency for an extended period, rather than trading it, with the expectation that its value will increase over time.

– Purpose: Common strategy among investors who believe in the long-term potential of a cryptocurrency.

– Example: Buying Bitcoin and holding it for several years despite market fluctuations.

Airdrop:

– Definition: The distribution of free tokens to individuals, often as a promotional activity or reward for early adopters and community members.

– Purpose: Raises awareness, encourages adoption, and rewards loyal community members.

– Example: A new project might airdrop tokens to users who sign up or meet certain criteria, such as holding a specific amount of another cryptocurrency.

Historical Context of Token Distribution Models

The intensive development of Web3 is driven by continuous innovations and process improvements, prompting project creators to constantly optimize. Trends in crypto often overlap and intersect, but when it comes to token distribution models, three key eras can be distinguished.

The ICO Boom (2017-2018):

Initial Coin Offering (ICO) was a popular method of raising capital where new cryptocurrency projects sold a significant portion of their initial token supply to early investors. ICO contributors aim to profit from yield farming by capitalizing on the appreciation of the value of native tokens. This period saw a massive surge in the number of ICOs, with projects raising billions of dollars quickly and efficiently.

However, the unregulated nature of ICOs led to numerous scams and fraudulent projects, resulting in significant financial losses for many investors. Notable examples include Pincoin and iFan, which collectively stole $660 million from about 32,000 investors in Vietnam. Another infamous scam, BitConnect, was revealed to be a Ponzi scheme after promising high returns through its lending program and BCC coin, leading to significant losses for investors. In response, regulatory bodies like the U.S. Securities and Exchange Commission (SEC) began to crack down on ICOs, classifying many of them as unregistered securities offerings. This led to increased scrutiny and legal challenges for numerous crypto projects.

Transition Period – Structured Vesting and Fundraising Strategies (2018-2020):

With the regulatory crackdown making ICOs less viable, projects began exploring alternative fundraising and distribution strategies. One approach that emerged was the use of structured vesting methods combined with tiered investment rounds. Instead of releasing all tokens at once, projects started implementing various unlock periods based on the type of investors.

Strategic investors and early backers might have different vesting schedules, with tokens being released gradually over time. At the same time, the fundraising process itself became more structured. Different investors had access to different rounds of investments at varying prices. Early investors might participate in seed rounds at lower prices, while later investors might enter at higher prices during subsequent funding rounds.

Source: https://cobie.substack.com/p/new-launches-part-1-private-capture

This structured approach aimed to reduce the immediate risks of price crashes and rug pulls. It provided a more sustainable ecosystem and stability to the projects. Initially, this strategy was beneficial, as it allowed projects to build a more controlled growth trajectory.

Current Period – Saturation and High Valuations (2020-Present):

However, as this structured vesting strategy became the industry standard, the market became saturated with projects launching at high valuations. This led to an inflated market where many projects had unsustainable valuations from the outset, making it harder for retail investors to extract value from new token launches. The proliferation of high FDV and low float models further exacerbated the problem. The outcome was an increased volatility and poor long-term performance for many tokens.

This period highlights the need for more innovative and transparent approaches to the token distribution process and valuation.

Evolution and Drawbacks of High FDV and Low Float Models

Implementation and Market Dynamics:

As the industry evolved, projects realized that they could leverage these vesting and tiered investment strategies to create speculative opportunities. By setting a high Fully Diluted Valuation (FDV) and only releasing a small portion of tokens initially (low float), projects could create artificial scarcity and drive up prices. This approach was initially seen as a way to attract attention and investment without triggering regulatory concerns associated with ICOs.

However, over time, the Web3 market has verified this strategy. It turns out that it affects two key aspects of the market:

- Most of the potential for profit in token markets goes to private investors who invest off-chain. It excluded regular investors from early deals. Also, many projects stay private for a long time, making it harder for regular investors to get tokens at a fair price.

- A significant portion of tokens is held by insiders who conduct over-the-counter (OTC) transactions. OTC is an alternative strategy for maintaining price stability, as it helps avoid big sell-offs in the secondary market. It allows large token holders, such as investors, to sell their tokens directly to buyers without using the public market. This makes the price public investors see on exchanges different from the real price. This difference can cause chaos when tokens become available. If private sales are much cheaper than public sales, the price may drop sharply when tokens are released, as everyone tries to sell and bring the price down to its true value.

Source: https://messari.io/report/mo-money-mo-problems

Who are the participants in token distribution?

Projects in Web3, due to their wide range of applications, attract a broad and diverse audience. Their inclusive nature ensures they are accessible to all internet users. The market comprises various types of agents, and properly characterizing them is crucial during the design phase. This allows for the development of incentive systems and helps protect projects against negative actions by some agents.

Groups that are particularly involved in token distribution:

- Venture Capitalists (VCs): They support high FDV strategies to foster strong initial valuations, helping to attract significant attention and investment.

- Crypto Exchanges: These platforms benefit from high trading volumes and fees, while promoting tokens to create a perception of exclusivity and demand.

- Project Teams: They use high FDV, low float strategies to attract initial investment, manage regulatory scrutiny, and ensure robust market valuations.

- Influencers and Market Makers: Influencers drive demand and community engagement, while market makers help maintain price stability and liquidity, preventing market collapses.

- Regulators and Policy Makers: Regulatory actions, such as the SEC’s ICO crackdowns, have led projects to adopt these strategies to comply with regulations and achieve their goals.

Memecoins

A fascinating phenomenon observed in the cryptocurrency market is the divergence of trends. High FDV and low float token models failed to satisfy some public investors who couldn’t find room for their own investments and profit from projects. Partly in response to this, memecoins emerged in the market. These projects are characterized by lower entry barriers.

Historically, memecoins have been considered as a joke asset, favored mostly by retail investors and positioned far beyond sensibility on the speculation curve, even for most crypto funds. Memecoins offer greater price fluctuations and are riskier, but they also provide opportunities for quick gains. They are accessible to a large audience, initially at low prices, and quickly gain popularity. Memecoins often experience significant price swings due to speculation and actions of internet communities. While they can yield substantial profits in a short period, they are also prone to sudden value drops.

People now rush to buy memecoins almost immediately once price activity picks up. It significantly reduces the correlative period of broader market price increases preceding memecoin purchases. Effectively, the market understands the game, eroding much of the predictive behavior and leaving memecoins largely as highly speculative (and fun) bets on market attention. For example, DOGE went from under a billion market cap to nearly $90 billion in less than a hundred days from late January 2021 to early May.

Source: https://messari.io/report/navigating-memecoin-mania

https://messari.io/report/memecoin-escape-velocity

https://messari.io/report/systematic-memecoin-investing

Market Analysis and Insights

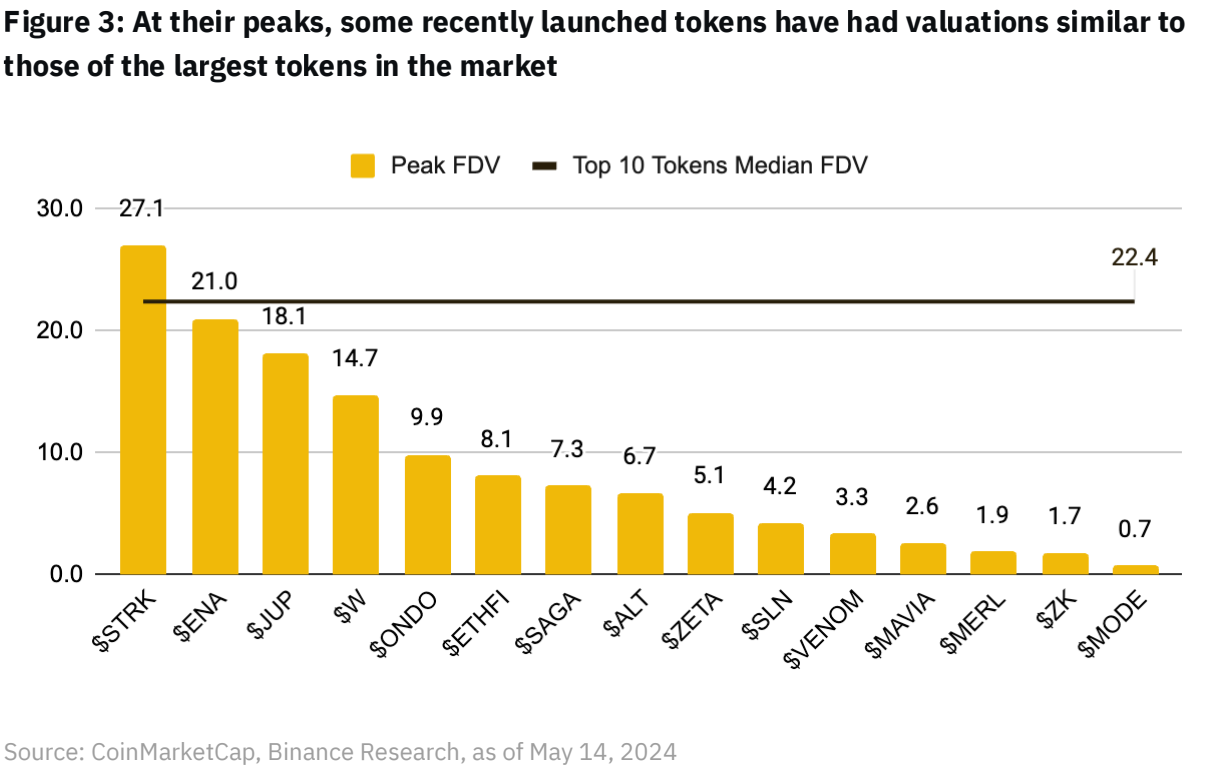

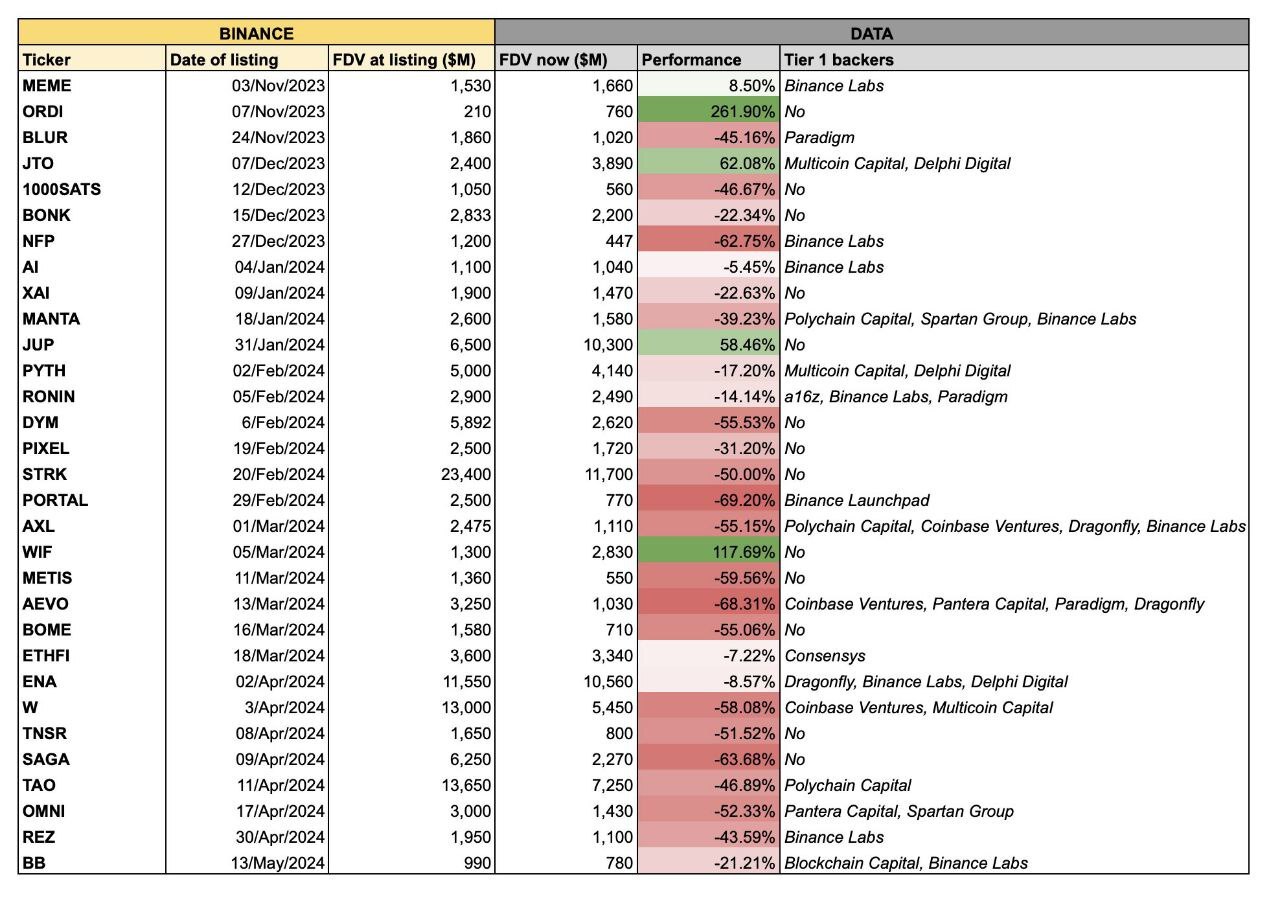

The initial enthusiasm for high FDV and low float token models has waned, revealing significant challenges and poor performance outcomes for many tokens. While memecoins have emerged as a notable exception with their unique market dynamics and immediate liquidity, this analysis focuses on the performance and trends of serious utility and governance tokens. A comprehensive review of the provided data offers a nuanced understanding of the market dynamics at play.

Source: (https://x.com/tradetheflow_/status/1791382914447573218) as of May 17, 2024

As a matter of fact data of recent token listings on Binance indicates that over 80% of these newly minted coins have seen a decline in value post-launch. For instance, while tokens like ORDI and JTO experienced significant gains (261.90% and 62.08% respectively), the majority, including PORTAL and AEVO, suffered steep declines (69.20% and 68.31%).

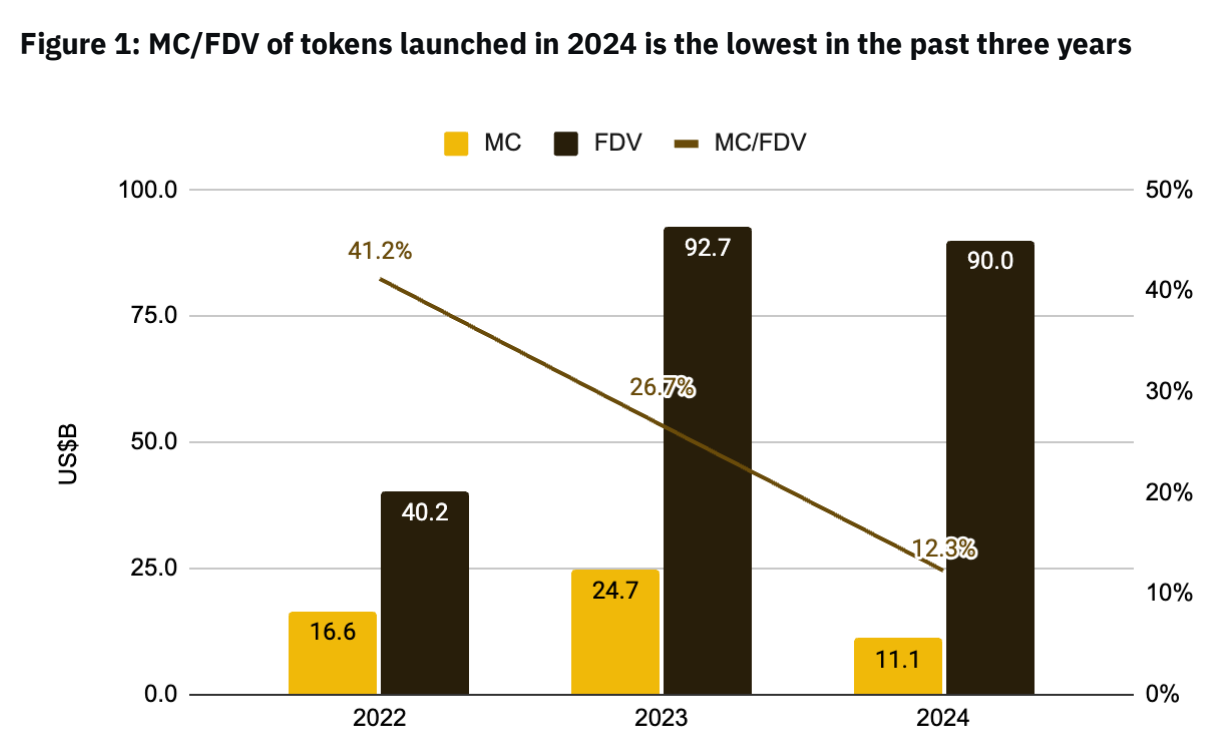

The Market Cap (MC) to Fully Diluted Valuation (FDV) ratio of tokens launched in 2024 is significantly lower than in the previous two years. This trend suggests that projects are becoming more cautious with their initial valuations, possibly in response to the underperformance of high FDV tokens. This aligns with the article’s discussion on the drawbacks of high FDV, low float models and the need for more sustainable tokenomics.

Source: Binance

Circulating Supply Analysis

The analysis of circulating versus locked supply shows that most recently launched tokens have a high percentage of their supply locked. This artificial scarcity can drive up prices initially. But, it often leads to high volatility and unsustainable valuations once the tokens are unlocked.

Source: Binance, as of May 17, 2024

Token supply design

When designing tokenomics, determining tokens supply involves estimating the company’s or project’s value and deciding on the percentage of tokens sold to investors and their valuation. Total token supply design consists of two key factors.

The first is considering the financial interest of investors. It is crucial to make our project attractive to investors by offering favorable conditions, ensuring they are willing to invest, and the project can secure funding. Early-stage investors anticipate returns post-launch, rewarding them for their funds and trust. Granting access to purchased tokens from the project’s inception, for use (staking or sale) is crucial. Releasing part of the token pool at listing time communicates with investors and impacts funding negotiations. However, Initial Supply shouldn’t be excessive, as a high supply may prompt investors to quickly sell, causing price drops.

Secondly, it involves dedicating tokens to address the system’s needs and for ecosystem development. Alongside distribution, ensuring adequate reserves and pools for ecosystem operation, rewards (e.g., from staking or airdrops), and reserves for optimal project functioning are vital aspects. These tokens, used internally for liquidity provision or initial reward pools, should be appropriately distributed to minimize early sales pressure and meet initial system needs, including marketing. Proper token distribution assures investors of the team’s development plan for the project’s long term viability. The number of allocated tokens for system operation may exceed the float – tokens available on the secondary market. This is a safe approach as ecosystem tokens usually don’t add to supply initially.

Once a token is available on the market, like a centralized exchange (CEX) with an order book or a decentralized exchange (DEX) with automated market-making, it will influence the token’s price.

Important mechanisms in planning token distribution

Most creators, when thinking about their project and planned tokenomics, have static values in mind, planned in advance and defined at the initial stage. However, tokenomics can also be designed dynamically to adapt to the changing needs of the system. The dynamics of these changes can impact token pools, and the needs of an expanding system can be addressed immediately. An example is adjusting the market cap as the system develops, avoiding excessively high initial valuations.

In addition to determining appropriate values for initial tokens supply, it’s also important to consider other mechanisms that impact project launches. Besides designing appropriate initial token distribution, it’s essential to remember incentives and mechanisms that reduce supply pressure post-token launch. Planning ahead is crucial as it allows for greater flexibility in constructing distribution mechanisms and a more fair and sustainable ecosystem.

Vesting:

One of the crucial mechanisms is vesting, which staggers the release of tokens over time, reducing the chances of large dumps. Importantly, vesting decreases selling pressure and distributes it over time. When a large number of tokens are in the vesting phase and therefore not yet circulating in the market, this may indicate a more limited supply and potentially higher value. Also, a massive release may indicate a future drop in value due to a sudden increase in supply or large amount of sell tokens.

Vesting has three main functions.

For the founders, team allocation in vesting shows their long-term commitment. It can reassure other stakeholders in the project and build their confidence in the project’s quality.

From the investors’ perspective, it acts as a mechanism that protects against sudden market fluctuations, contributing to greater stability.

For the community around the project, vesting allows for a fair distribution of tokens and more equitable and democratic participation conditions. It can also serve as motivation for the community to engage. Project creators can operate vesting by shortening its time frames as users complete tasks and reach certain milestones within the system. This type of vesting is known as dynamic vesting, or event-driven vesting. In this mechanism, users receive tokens after a specific event or upon reaching milestones by the project. The predetermined events and subsequent vesting are part of a marketing strategy that, when properly executed, drives activity around the project. It can respond to price changes or minimize negative trends, significantly impacting the liquidity and stability of the token market.

Compared to dynamic vesting, classic vesting, also known as time-based or linear vesting, releases a set number of tokens at regular intervals, such as monthly or annually, until all tokens are released. Currently, we see a trend of longer vesting periods, reflecting a more strategic, long-term approach by project creators.

Airdrops:

Especially in the early stages of a project, finding and building a committed community is crucial. It allows for the subsequent project development and long-term loyalty. One such mechanism that has become very popular in Web3 recently and significantly engages participants is Airdrop.

Airdrops involve the distribution of tokens to the community to generate buzz about the project and attract community interest. In the initial stages of a project, they function as part of the marketing campaign, often requiring users to meet specific conditions, such as joining a Telegram group, retweeting a post on Twitter, or playing a demo game in the GameFi sector. In later stages, it is beneficial to reward community members whose behavior is favorable for the project’s dynamics, such as holders or stakers.

The emergence of Airdrops was also motivated by legal regulations that appeared after the popularity of Initial Coin Offerings (ICOs). This mechanism became an alternative to ICOs, as it allowed to distribute tokens to a large number of users while avoiding being classified as an illegal securities offering.

The success of Airdrops is evident. New projects in the Web3 space quickly gain popularity thanks to this mechanism. New users are particularly attracted by Airdrops from various new projects, which allows them to familiarize themselves with the ecosystem and develop long-term loyalty, contributing to its sustained growth. A good example of the effectiveness of this approach is SOL, the native token of Solana, which saw a 500% increase in value since early 2023. This period coincided with a season primarily driven by the start of DeFi Airdrops and significant growth in application development on the network.

Sources: https://messari.io/report/analyzing-solana-s-growth

https://messari.io/report/airdrops

Airdrop Strategies and Their Impact:

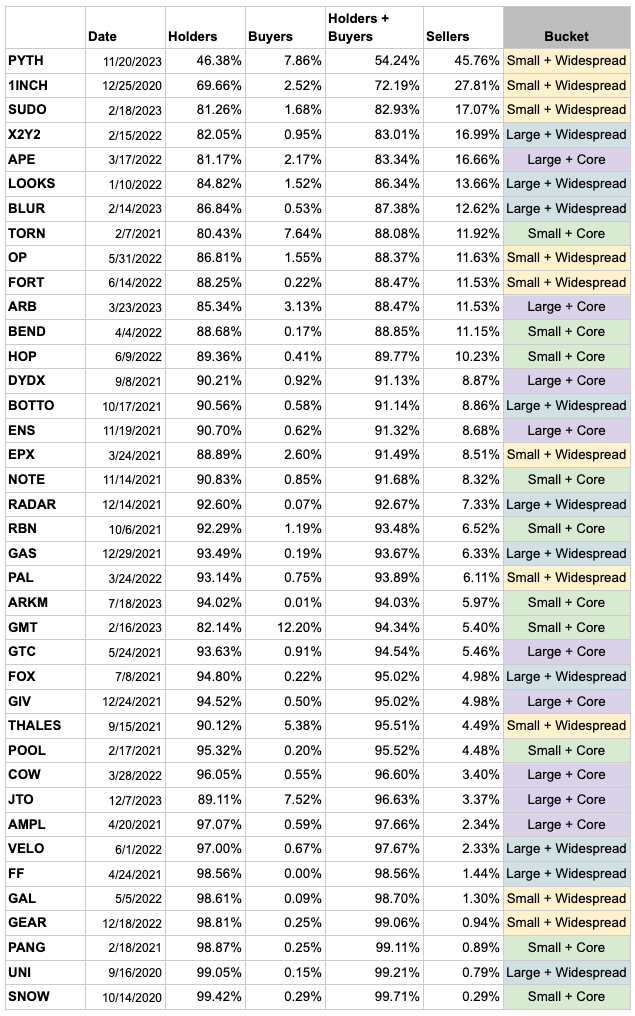

The effectiveness of Airdrops is clearly evident, but project creators may still wonder what specific Airdrop rules will best suit their project’s needs. As always, it is crucial to tailor the rules to individual needs, depending on whether we want to motivate a particular group within the community or the entire community, whether we prefer regular token distributions, or to operate them based on the project’s development and changes in its value dynamics. Nevertheless, there is some data suggesting the superiority of certain approaches over others.

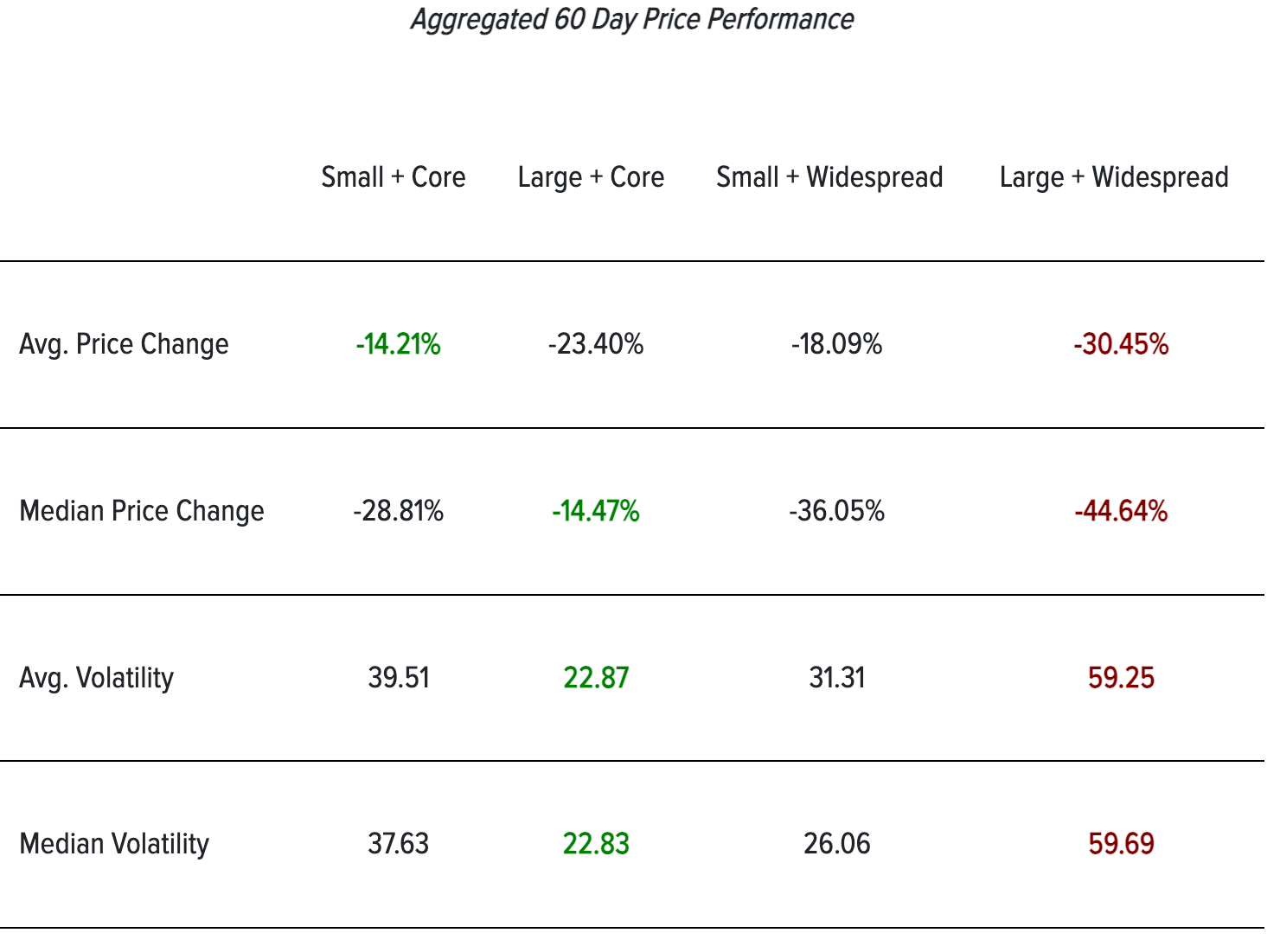

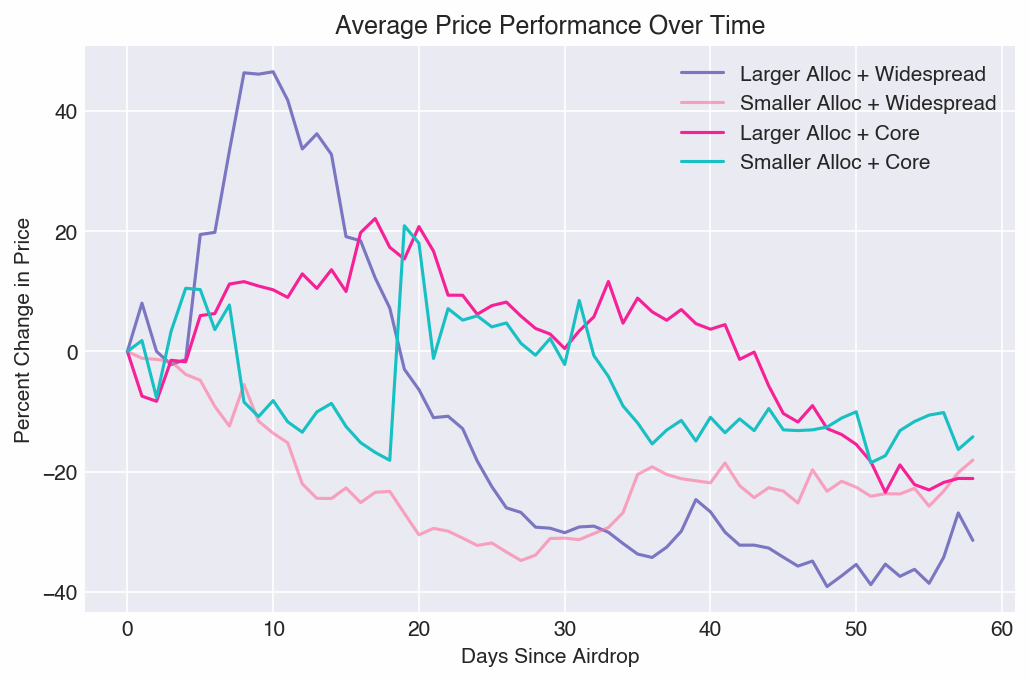

Targeted Airdrops vs. Widespread Distributions: The data indicates that smaller, targeted Airdrops to core users yield better outcomes than large, widespread distributions. It’s beneficial to select specific groups within the community to reward for their engagement in the project, which can be understood as fulfilling certain criteria or stacking. For example, tokens distributed with small allocations to core users (like UNI and PYTH) showed higher retention and less volatility compared to widespread distributions.

Source: 6th man as of May 20, 2024

Conclusions which can be drawn

Target Core Users for Airdrops

Distributing tokens widely can be expensive, especially if recipients are inclined to sell them quickly. Instead, focusing on core users who contribute to liquidity mining and usage is more effective. Data demonstrates that rewarding these core users leads to higher retention rates. Attempting to convert non-users through Airdrops is unlikely to yield significant results. By incentivizing the core community, not only does it foster stronger holder retention, but it also stimulates buying momentum and drives up prices. Additionally, the psychology of motivation confirms that the exclusivity of the reward enhances its perceived value, as it is not accessible to everyone. This sense of exclusivity can increase the subjective evaluation of the reward.

Prefer Smaller Airdrops

The size of an Airdrop has minimal impact on price and volatility, making it preferable to keep them smaller. Tokens play a critical role in initiating usage and liquidity, particularly when the project intends to continue its development. Maintaining a larger reserve of tokens allows for future rewards to incentivize users and liquidity. However, Airdrops should still be substantial enough to effectively reward early venture capital and inspire community engagement.

Source: https://followin.io/en/feed/10549481

Staking:

Another mechanism worth considering for a project’s long term success is staking, which allows users to multiply their capital, thereby discouraging quick token sales and project abandonment. This mechanism, as well as holding, aims to reduce selling pressure after the project’s launch.

Staking is a very positive mechanism in projects as it allows users to generate passive income and increases the time they remain engaged with the project. Therefore, stakers are often a group that is appreciated through other incentive mechanisms, such as participation in Airdrop campaigns or staking being the basis for voting in some projects with decentralized autonomous organization.

It’s important to note when planning tokenomics that the staking rewards pools are contained within the ecosystem pool. A well-designed system should be self-efficient, generating its own inflow and replenishing the staking reward pool.

Holding Behavior:

Analysis of holder behavior reveals that core users tend to hold or buy more, indicating stronger community support. In contrast, widespread distributions see higher sell-off rates, leading to increased volatility and price declines.

Source: 6th man as May 20, 2024

Volatility Analysis:

Tokens with large and widespread allocations experience the highest volatility. The average volatility for such tokens is significantly higher than the one for tokens with smaller, core-focused allocations. This indicates that a more conservative and targeted distribution approach can lead to more stable market behavior.

Source: 6th man

Strategies for Better Tokenomics Design

Based on our data analysis, market insights, and extensive experience in the web3 industry, we’ve identified several strategies that could significantly improve the sustainability and transparency of today’s tokenomics. Here are our assumptions and recommendations:

- Context is crucial for tokenomics:

- The context of your project determines the appropriate planning of tokenomics and its liquidity. Projects will differ based on the utility of the token. The context can include DeFi, GameFi, DAOs, and others.

- Substantial Initial Circulating Supply:

- Ensure at least 20% of tokens are in circulation at listing to prevent price manipulation and ensure accurate market valuation.

- Balanced Vesting Schedules:

- Implement partial vesting at Token Generation Events (TGE) followed by further vesting within 6-12 months. This method supports continuous engagement and fair price discovery.

- Transparency in Token Distribution:

- Provide clear and detailed information about token distribution model, vesting schedules, and the role of tokens within the ecosystem.

- Automated and Audited Processes:

- Use open-source and audited smart contracts for token operations, ensuring every step is secure and visible to stakeholders.

- Plan Incentive Mechanisms:

- Incentive mechanisms such as staking or Airdrops drive activity of token holders within the project and are an important part of the marketing strategy.

- Effective Token Distribution Methods:

- Utilize token streaming for gradual release, reducing volatility and aligning with project milestones and user engagement.

- Validation:

- Conduct simulation exercises before the project’s launch to check the dynamics of price changes and the economical network security of planned pools.

By adopting these strategies, projects can build a more sustainable and transparent ecosystem.

Building a well-structured tokenomics framework that fits seamlessly into a project idea and context can be quite a challenge for its creators. Many teams resort to copying known solutions and traditional static strategies. If you’re curious why such an approach is doomed to fail in the long run, read the article at: Tokenomics Explained: Tokenomics Depends on the Context

Tokenomics Explained – Tokenomics Depends on the context

Conclusion

The trend of high FDV, low float tokens has revealed its limitations. Web3 is a dynamic environment where one trend displaces another, and the same applies to token distribution strategy. Amidst the multitude of projects, various solutions can be found—some profitable, others hitting rock bottom. However, it’s crucial not to blindly follow past successes. The foundation of well-planned tokenomics and token distribution lies in understanding the project’s needs, limitations, and expectations. These factors should guide the direction and mechanisms chosen. Defining the context and success indicators and aligning tokenomics with them is key to success. Rather than sticking to fixed values, considering unique distribution patterns and more dynamic solutions that allow for adaptation to system changes and evolving needs is advisable.

Recognizing the three main needs of creators in tokenomics support, tokenomia.pro and tokenops cover them comprehensively:

Designing phase:

- Tokenomics Development:

- We assist in designing and developing robust tokenomics models tailored to your project’s specific needs and objectives.

- Economic Mechanism Design:

- Our team specializes in creating economic mechanisms that drive user engagement, incentivize desired behaviors, and promote ecosystem growth.

- Psychological Profiling of Agents:

- We conduct in-depth analyses to understand the psychological motivations and behaviors of project stakeholders, helping to optimize incentive structures and user experiences.

- Incentive Mechanisms:

- We design and implement effective incentive mechanisms allowing token holders to get reward for their contributions, fostering long-term engagement and loyalty.

- Comprehensive Coverage:

- Our consulting services provide comprehensive coverage throughout all phases of your project, ensuring that your tokenomics strategy is well-aligned with your project goals and objectives.

Validation phase:

- Mathematical Specification:

- We offer mathematical modeling and specification services to provide a clear framework for understanding the dynamics of your project.

- Creation of a Digital Twin:

- Using the cadCAD model in Python, we create digital twins of your project to simulate real-world scenarios and optimize decision-making processes.

- Validation through Simulation:

- We conduct simulations to validate assumptions and analyze system dynamics, allowing for informed adjustments and optimizations.

- Validating Economic Security:

- Simulations help identify the biggest threats to flow tokens in the system and assess their economic safety.

- Simulation Analysis and Recommendations:

- We examine simulation results to understand trends and offer practical suggestions via detailed reports.

- For more information, visit https://tokenomia.pro/

If you are interested in evaluating existing projects in terms of their tokenomics or validating your own project’s assumptions, you can use the Tokenomics Simulation tool – TPRO Network. It allows you to simulate changes in price dynamics, token supply, the volume of tokens bought and sold, as well as the behavior of various agents in both primary and secondary markets. The tool enables you to observe how the project will behave under specific demand and sales conditions.

If you need an in-depth consultation regarding your project and to carry out all the steps mentioned above, don’t hesitate to schedule a meeting with our tokenomics consultant.

Observation and reaction:

Many of the needs for more sustainable tokenomics are satisfied by TokenOps, a platform dedicated to token operations and lifecycle management. TokenOps help streamline the token creation process, offering tools for transparent and balanced token distribution, real-time analytics, and efficient management of vesting schedules. TokenOps addresses the key issues identified in the current market:

- Transparency in Token Distribution:

- TokenOps provides detailed reporting and tracking tools that enhance transparency and build trust with investors. By offering a clear view of token allocation and distribution, projects can ensure accountability and foster investor confidence. Their platform uses open-source and fully audited smart contracts, ensuring every step of the process is secure and visible to stakeholders.

- Balanced Vesting Schedules:

- TokenOps offers the possibility to build flexible and customizable vesting schedules that balance early investor rewards with long-term project sustainability. This helps prevent large, sudden unlocks that could destabilize the market.

- Innovative Distribution Methods:

- TokenOps supports innovative token distribution methods, including token streaming and dynamic vesting. These methods help maintain price stability by releasing tokens gradually, aligned with project milestones and user engagement.

- Substantial Initial Circulating Supply:

- TokenOps assists projects in managing their initial circulating supply to ensure proper price discovery. By having a substantial portion of tokens in circulation right from the start, they help prevent price manipulation and ensure a more accurate market valuation.

for more info visit https://tokenops.xyz/

The crypto industry must shift towards sustainable tokenomics, prioritizing transparency, fair vesting schedules, substantial initial circulating supply, and innovative distribution methods. Looking ahead, the crypto market may see a shift towards models that prioritize transparency and fair distribution. Innovations in DeFi and NFT integration could also influence tokenomics strategies in the coming years.

Let’s talk about Token Distribution Design

The best first step is to talk to our consultant. During a free consultation, you can check the consultant’s competences and look for initial solutions to the challenge that is currently most important for your project.