The Ultimate Token Launch Checklist

Essential Steps to Take Before Launching a Token

We’ve prepared a comprehensive, fillable checklist covering the key elements you have to implement before listing your token. This guide ensures no essential steps are overlooked, setting your token up for sustained, long-term success in the market.

This checklist provides a condensed version of everything covered in the article, offering a clear and actionable summary. By using it, you can quickly reference all essential points, ensuring nothing important is overlooked.

At Tokenomia.pro, we bring experience from working daily with clients, addressing challenges that new projects typically face before launch. We also recognize how overwhelming it can be to navigate the vast information and varying advice available online. Cognitive overload and stress often accompany this stage, so to ease the burden on future project creators, we’ve written this article.

By following the article and using our checklist, you can assess your team’s readiness, confirm all formalities, and ensure your strategy aligns with best practices, allowing you to:

– Avoid costly mistakes that can hinder your token’s success

– Solidify the best possible strategy for your token launch

– Be prepared and confident on the day of the listing

Right Network: The Foundation of Your Project

One of the most critical steps for a successful token launch is selecting the right network for your project. From our experience, this is an area that many project creators overlook, often underestimating its importance. Choosing the right network is fundamental to long-term success.

When it comes to choosing a network, there isn’t a one-size-fits-all answer that works for every project. Each network has its unique set of attributes—advantages and limitations. You must select a network that aligns with your project’s specific needs by considering its key characteristics:

- security and sustainability

- stability and speed

- network’s costs

- technical integrity

- community around the network

- TVL indicating popularity

- compatibility with the Ethereum Virtual Machine,

- available additional network support.

Consider technical infrastructure and Network’s Cost

Assess the technical infrastructure of the network, focusing on security and sustainability. The underlying technology should align with your project’s long-term goals, providing a solid foundation that can scale with your growth. Check whether the network has a history of security breaches or vulnerabilities and how well it handles upgrades and scalability. Your project’s success depends on a stable, secure network, especially if you plan to operate in the DeFi or NFT space where security is paramount.

Stability and speed performance are critical. Evaluate how consistently the network handles transactions without disruptions or downtime. High-speed, reliable networks ensure a smooth user experience, reducing frustration and increasing user retention. Remember, any delays or instability could negatively impact user confidence and engagement, which is especially important for DeFi applications, games, or platforms with high transaction volumes.

Tip:

If your project is designed to operate across multiple networks, make sure to establish efficient bridges between them. These bridges will enhance interoperability, allowing assets and data to flow seamlessly and providing users with a unified and smooth experience.

Transaction costs play a pivotal role when selecting a network. Understanding your project’s use case and the expected activity level of your community can help you gauge the cost implications. Network fees directly impact profit margins, and while some projects can handle higher fees, others—especially high-frequency applications like GameFi—may find such costs prohibitive. For example, operating a GameFi project on Ethereum alone could be financially unsustainable due to high transaction fees, which is why many projects in this space seek niche chains or networks optimized for gaming.

Also, the network you choose should provide access to the essential technologies needed for building your project. It’s important to verify that the selected technology is compatible with the protocols you intend to use in your project’s development. If you’re exploring Layer-2 networks, resources like https://l2beat.com/scaling/summary offer critical insights into their technical maturity, sustainability, and security. This platform is invaluable for conducting research and assessing risks, showing how stable and secure each network is. Additionally, L2Beat provides metrics such as Total Value Locked (TVL), activity levels, and risk analyses to inform your decision.

Understand Community and Network Ecosystem

A network’s reputation can influence your project’s perception. Look at whether the network hosts successful projects similar to yours. Being part of an ecosystem with a proven track record of supporting projects in your niche can bring strategic benefits, such as a ready audience that understands and is interested in your offering. It can also open up opportunities for partnerships and collaborations, increasing your project’s reach and impact.

Each network attracts a distinct community. Some networks, like Solana, are popular for DePIN projects, while others cater to GameFi or DeFi. Selecting a network with an existing user base interested in your project’s niche can help you secure early adopters and establish partnerships with other projects. It’s also strategic to identify gaps within the network ecosystem where your project can offer unique value. By understanding the existing “market within the network,” you can position your project to leverage its strengths and stand out. This insight not only enhances visibility but also optimizes your project’s growth potential within the network.

Network Total Value Locked (TVL)

From a business standpoint, keeping an eye on a network’s Total Value Locked (TVL) across various protocols is incredibly insightful. TVL acts as a popularity barometer and liquidity gauge, giving you a snapshot of where significant activity and capital flow are happening. Platforms like DeFiLlama make it easy to track TVL across different chains.

In addition to TVL, metrics like transaction volume and stablecoin market cap provide a deeper understanding of where user interest and liquidity are most concentrated. These indicators can be powerful tools in guiding your decision about which networks to prioritize for your project.

The graphic shows the total TVL across all networks as of November 6, 2024.

Source: https://defillama.com/chains

Network Type: EVM vs. Non-EVM

An important consideration is the technology underlying the network, as this affects compatibility, developer expertise, and cost. Deciding between an EVM-compatible network (such as Ethereum, Base, or Polygon) and a non-EVM chain (like Solana or Aptos) will influence the technical stack required and the skill sets your team needs.

From a cost perspective, it’s essential to have a team capable of development and maintenance within the chosen ecosystem. While your team may already have strong technical skills, aligning them with the specific requirements of EVM or non-EVM technology is critical. For instance, EVM-compatible networks often utilize Solidity developers, while non-EVM chains like Solana may require expertise in Rust or other languages.

Factors to guide your decision:

– EVM Networks – Compatible with the Ethereum Virtual Machine, supported by Solidity developers, and typically offer easier integration with Ethereum-based tools.

– Non-EVM Networks – Often require Rust or other specific expertise, such as with Solana, and may offer distinct benefits or innovations outside the Ethereum ecosystem.

Additional Network Support

From experience, we know that many projects choose networks that offer valuable support at the early stages. Many networks provide assistance to new projects, enhancing their chances of success through a range of resources:

- Development Support

Networks may supply advanced technologies or assist in developing custom solutions, helping projects establish a solid technical foundation.

- Marketing and PR Support

Networks often promote new projects through their established social channels, introducing them to a wider community and accelerating early-stage growth.

- Grant Programs and Funding

Some networks offer grants or investments to incentivize projects to build within their ecosystem. These funds not only help builders realize their vision but also enhance the network’s ecosystem by attracting new, utility-driven projects. This symbiotic relationship benefits both sides: builders gain the resources they need, while the network strengthens its platform with innovative projects, making it more attractive to end-users.

Evaluating the support a network offers can be a strategic advantage, particularly when building traction and visibility in a competitive space.

Once you’ve chosen the appropriate network, it’s time to focus on the next crucial step: crafting a strategy for the secondary market!

Exchange Strategies: Navigating the Secondary Market – CEX vs DEX

Choosing the right exchange for your token may seem secondary but is actually a pivotal decision, influencing everything from price dynamics to long-term liquidity. Your initial choice between centralized exchanges (CEX), decentralized exchanges (DEX), or a hybrid approach will shape your token’s market trajectory.

Centralized Exchanges (CEX)

Centralized exchanges are platforms where a central intermediary facilitates trading between users. These exchanges operate with an order book system that displays and matches buy and sell orders, resembling traditional finance exchanges. By using CEXs, users entrust their funds to a third-party institution that manages their assets.

- Market Maker Collaboration

CEXs often collaborate with market makers who ensure liquidity for trades by managing buy and sell orders. Effective partnerships with market makers can vary significantly in terms of fees, settlement structures, and order management processes, making it essential to negotiate terms that align with your project’s needs.

- Listing Costs

Listing on a CEX can be costly, with fees varying widely between platforms. Some exchanges offer tiered listings, where higher tiers provide better visibility and perks like dedicated market-making support. Factoring these costs into your early budget is crucial, as a high-profile listing can consume substantial resources.

- Legal and Regulatory Requirements

Listing on CEXs may involve extensive legal preparation, especially in regions with strict regulations, like the EU under the forthcoming MiCA framework. Ensure compliance with international standards and be prepared for audits and KYC/AML requirements.

- Examples: Bybit, Binance, Coinbase, Kraken

Decentralized Exchanges (DEX)

Decentralized exchanges allow users to swap crypto tokens in a non-custodial, permissionless environment, bypassing centralized intermediaries. Without an order book, DEXs use Automated Market Makers (AMMs) and liquidity pools to determine token prices based on a mathematical formula, commonly x⋅y=kx⋅y=k, where xx and yy represent token balances and kk is a constant.

- Liquidity Pools and Automated Market Makers (AMMs)

DEXs use liquidity pools managed by AMMs to facilitate instant, 25/7, decentralized trading without relying on traditional market makers. This structure democratizes liquidity provision but requires careful planning to prevent liquidity depletion, especially in volatile markets. Insufficient liquidity can cause high price impact (slippage), increasing volatility and potentially harming the project’s reputation. A well-designed pool, funded with a balanced mix of tokens and stable assets like ETH or stablecoins, can help maintain long-term price stability.

- Reserve Management

Maintaining reserves in stablecoins or ETH can help support liquidity pools and stabilize token prices. Regular adjustments to these reserves, based on market conditions, can prevent sudden price drops and boost community confidence. For example, a rebalancing strategy could be used to realign token allocations as prices or trading volumes shift.

- Examples: Uniswap, SushiSwap, PancakeSwap

Balancing CEX and DEX Strategies

It’s important to consider the users’ perspective when making this choice, as their engagement will drive our project forward.

Centralized exchanges (CEXs) offer larger trade volume and higher liquidity, simple fiat-to-crypto conversions, and faster transactions due to off-chain processing, making them user-friendly and accessible for beginners. However, using a CEX requires users to complete identity verification (KYC), compromising privacy. Users also lack control over their funds since the platform holds the private keys, exposing them to potential losses from hacks.

In contrast, decentralized exchanges (DEXs) enable self-custody, giving users full control over their assets without KYC requirements. DEXs reduce security risks, as funds remain in non-custodial wallets and are less vulnerable to platform-level hacks. They offer access to new tokens through permissionless listings, allowing early participation in emerging projects. However, DEXs often lack advanced trading options, have slower transaction speeds due to on-chain processing, and typically experience lower liquidity compared to CEXs.

Both CEX and DEX listings come with unique challenges, and for many projects, a balanced approach with well-balanced strategy may involve both types to reach different audiences. Whichever path you choose, a clear, well-prepared exchange strategy will support price stability and community trust.

Why is making a decision early so important?

We believe that only after selecting or at least shortlisting your network and defining an exchange strategy can you secure external funding from investors. This decision helps you estimate upcoming costs accurately. For example, there’s a significant difference between listing on a top-tier centralized exchange with substantial market maker support versus a smaller DEX with limited liquidity. If you plan to list on multiple exchanges, be aware that each listing incurs additional complexity and cost, particularly due to possibility of arbitrage across markets.

Once you have chosen the appropriate exchange strategy, you’re ready to proceed with designing specific market metrics and further steps in your token launch journey.

Market Metrics: Tracking Key Indicators for Investment Appeal

When private investors, venture capitalists, or advanced community members consider investing in your project, they’ll pay close attention to certain key market metrics. These metrics provide a foundational snapshot of the project’s market viability and potential for growth.

The essential metrics to consider

– Listing Price

– Initial Supply

– Initial Market Cap

– Total Market Capitalization

– Max Supply (if applicable)

– Fully Diluted Valuation (FDV)

Balancing these metrics is crucial to ensure the project’s success while also meeting investor expectations. Finding the right compromise can often feel like a negotiation game, involving discussions, calculations, and careful adjustments. For example, investors typically seek a lower FDV to maximize their share, but this might not align with the team’s or community’s goals. As a project creator, you must have solid reasoning behind each metric to justify your decisions.

Our approach to that is Comprehensive Market Research:

Our solution involves thorough, in-depth market research. By deeply understanding the goals and objectives of the project, we analyze all comparable projects within the sector. Web3’s open nature means there’s no strict regulation on market metrics, leading to a variety of approaches. However, our research helps identify a „golden standard” that balances investor appeal with practical viability.

Our example visualization of market positioning:

The graphic above illustrates how we present our research:

– Blue Dots: Competitors

– Green Dot: The project we collaborated on at the time

Benefits of Market Benchmarking

By using such visuals, project creators can clearly demonstrate to potential investors how their metrics compare within the competitive landscape. Rather than shooting in the dark with random numbers, this approach allows you to support your choices with clear reasoning based on market standards. Of course, this should be further reinforced by sophisticated calculations that substantiate the established metrics, providing a robust foundation for your decisions.

This process not only builds credibility with investors but also serves as a valuable validation tool for project creators. Analyzing similar projects with comparable metrics allows you to understand how they performed under market conditions, saving you from repeating mistakes made by others.

Tokenomics Design: The Foundation of a Balanced Ecosystem

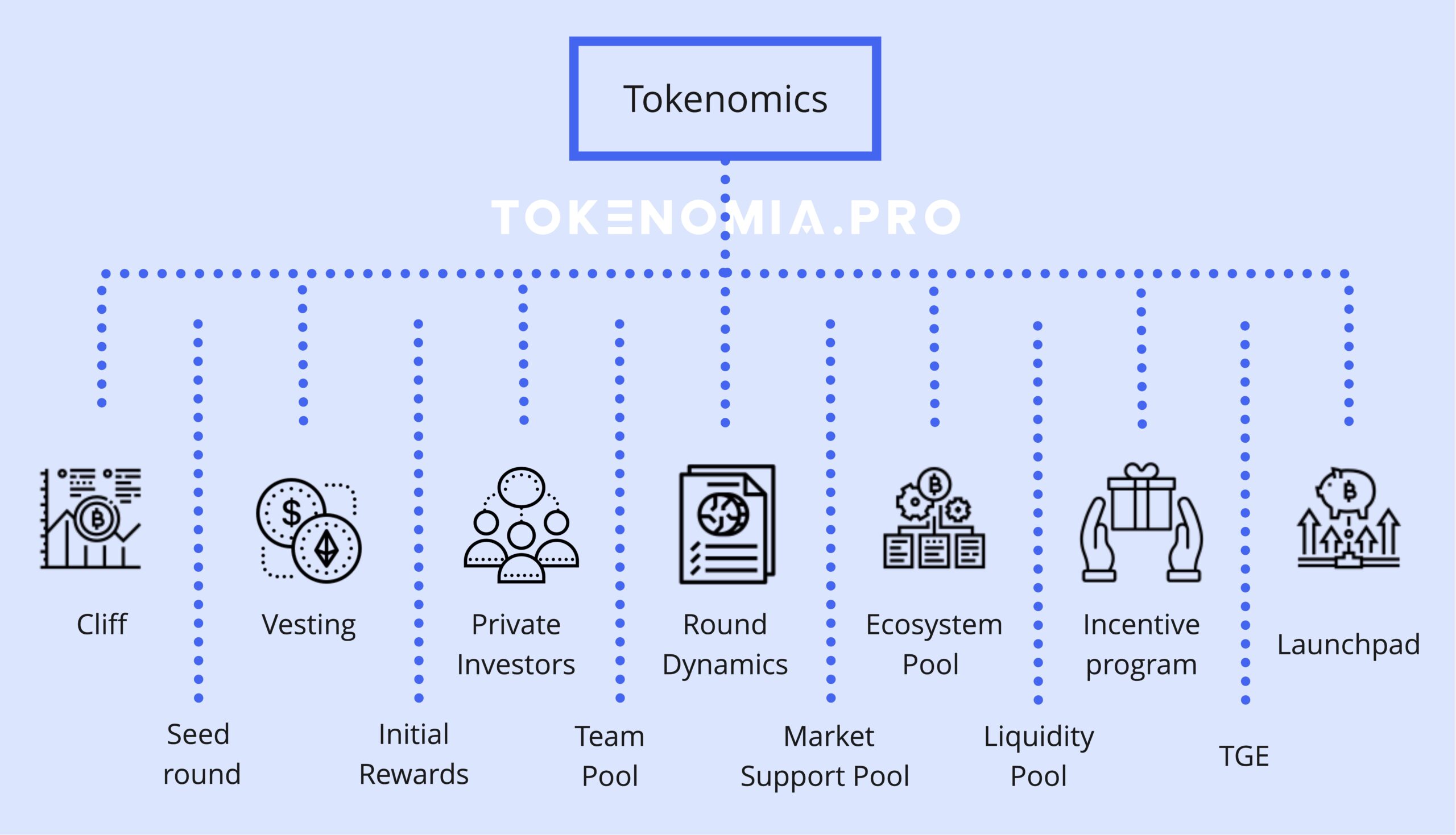

In the context of token launches, we view tokenomics as a structured description of the conditions under which investors, the project team, and the broader community acquire and interact with the token.

A robust tokenomics framework involves several critical components, including:

- Cliff

- Vesting

- TGE

- Round Dynamics

- Ecosystem Pool

- Liquidity Pool

- Market Support Pool

- Seed round

- Private Investors

- Launchpad

- Team Pool

- Incentive program

- Initial Rewards

All these components should be carefully tailored to the specific context, goals, and sector of the project.

Case Study

Tokenomics Explained – Tokenomics Depends on the context

A thoughtful approach to designing tokenomics is essential, as there are various strategies available in the market. We can distinguish between effective and ineffective approaches to building tokenomics.

Ineffective approach:

Quick Profits over Sustainability

Some projects, particularly memecoins, skip detailed tokenomics planning in favor of rapid „pump and dump” cycles. These projects often lack the fundamentals needed for sustainable growth and rarely focus on maintaining a balanced ecosystem.

Copying Established Tokenomics

Another approach is replicating the tokenomics of established, successful projects. However, this strategy is often ineffective because each project launches under unique market conditions, with distinct demand-supply dynamics and different levels of community engagement. Even if your tokenomics structures appear similar, factors like partnerships, market positioning, and sector-specific requirements can vary widely, affecting the project’s success.

Effective and recommended approach:

Data-Driven and Calculated Tokenomics

This strategy involves a tailored, research-based approach, requiring critical analysis, competitor model examination, and collaboration with industry experts to create a structure aligned with the project’s unique needs. However, this method often relies on initial assumptions that set fixed values for certain variables, which can be risky. Setting rigid parameters based on early data can limit adaptability and lead to potential errors when the project operates in a live environment.

Iterative Tokenomics Based on Simulation

Our experience shows that the most effective way to design tokenomics is through a dynamic, iterative process that integrates research, comparison, and simulation. This method enables continuous optimization, ensuring tokenomics are well-adapted to real-world conditions while minimizing risks. By leveraging simulations, we can stress-test different economic scenarios, identify potential vulnerabilities, and make data-driven adjustments. This proactive approach not only enhances the sustainability of token ecosystems but also fosters investor and user confidence, as it demonstrates a commitment to well-researched and adaptive economic models. Our approach distinguishes two options for conducting simulations:

Custom Simulations for Clients

Based on your project idea and description, we build a digital twin of your system in the form of mathematical models. Using advanced tools like CadCad, we conduct hundreds or even thousands of scenario tests on this virtual entity, analyzing various mechanisms and metrics to evaluate demand-supply dynamics and market pressures. From these results, we generate a comprehensive report assessing the soundness of the tokenomics design and identifying refinements to better manage market fluctuations, such as sell pressure.

Let’s talk about Simulations

The best first step is to talk to our consultant. During a free consultation, you can check the consultant’s competences and look for initial solutions to the challenge that is currently most important for your project.

Accessible Simulations on TPro

For those who prefer hands-on experimentation, we offer TPRO Network, where users can conduct their own simulations. TPro Network allows you to test custom conditions, quickly assessing their impact on price dynamics and project sustainability. This flexible platform lets you answer specific project-related questions, such as:

- How will different market conditions affect price dynamics?

- What are the critical lifecycle moments in my token’s journey?

- How can varying liquidity levels impact token stability?

By simulating these factors, you gain insights into the strengths and potential vulnerabilities of your tokenomics model, empowering you to make informed adjustments before launch.

On-chain simulation

There are also tools such as on-chain simulation and validation on smart contracts, which provide insights into how these mechanisms interact under various conditions.

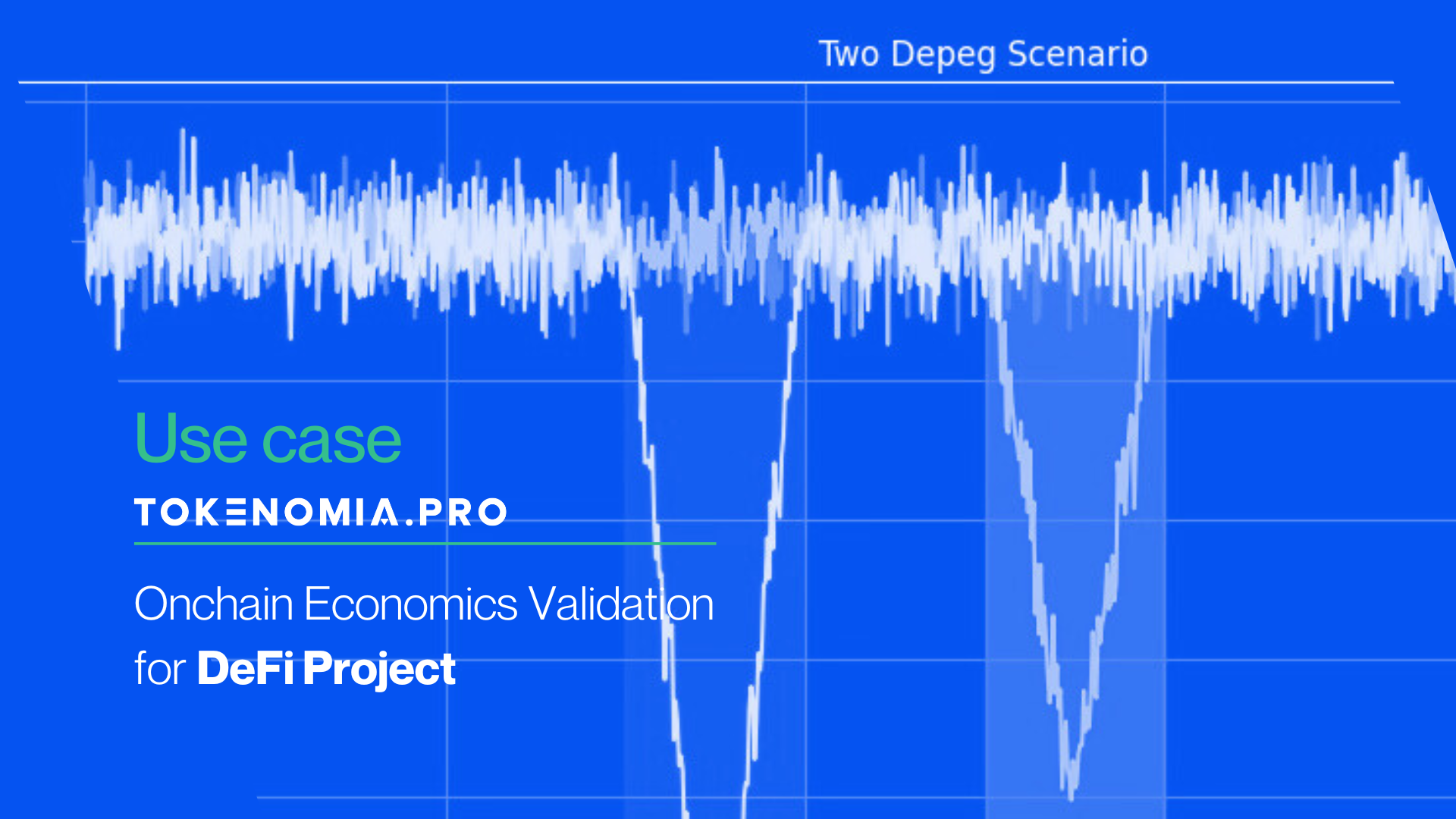

Case Study

DeFi Onchain Economics Validation

Simulation allows teams to validate and refine their designs, ensuring that the economic structure supports sustainable growth and resilience within the project’s ecosystem. A key advantage of this approach is that it doesn’t require building a digital twin or complex mathematical models; instead, simulations can be performed directly on existing but unreleased smart contracts.

Advantages of Simulation-Driven Tokenomics

This simulation-driven approach enables you to fine-tune your tokenomics without risking investor funds or project reputation. By gaining these insights, you can iteratively adapt your tokenomics, refining mechanisms to withstand even extreme market conditions. Identifying critical lifecycle moments—such as peak sell pressure—and understanding token price dynamics across cycles helps build resilience into your project’s design.

Simulations offer a flexible, laboratory-like environment where assumptions can be safely tested, key metrics assessed, and investment areas with the highest potential returns identified. For example, simulations allow you to pinpoint where additional funding, media attention, reward incentives, or reserve allocations would bring the most benefit. Crucially, simulations provide a clear way to answer all investor and founder questions before the project’s launch, validating the model prior to development. This proactive testing not only builds confidence but also significantly reduces costs by identifying necessary adjustments ahead of time.

Proof for Investors

This iterative, simulation-based approach doesn’t just minimize risk—it also provides solid data to support your strategic decisions. Simulations serve as compelling proof for investors, demonstrating the logic, effectiveness, and projected stability behind your tokenomics, pricing models, and market expectations over time.

Agent Interactions: Understanding and Shaping Community Behaviors

The key to any project’s success lies in its community—the end-users who create demand and drive the token’s popularity. A well-designed project anticipates and addresses the needs of its users, offering solutions to real problems. However, identifying and understanding these users is the first critical step. In economic analysis, everyone involved in a project is considered an „agent,” each playing either a positive or negative role in the ecosystem.

Agents’ behaviors influence the project’s stability and success. The goal is to design demand and supply mechanisms that minimize negative behaviors while encouraging positive contributions. It’s also essential to identify where agents’ behaviors or needs conflict—these points of friction can lead to dissatisfaction or encourage destabilizing actions, which we refer to as „collusions.”

To assist with this, we use a template designed by us to discover and assess potential collusion scenarios. By recognizing these situations, we can refine mechanisms or strengthen this part of the project’s economy to withstand extreme conditions.

Protecting the System with Positive Incentives

To safeguard the system against negative behaviors and conflicts, it’s crucial to develop a set of mechanisms that:

– Encourage Positive Behaviors – Motivate agents to contribute in ways that benefit the ecosystem.

– Discourage Negative Actions – Implement deterrents for behaviors that harm the project.

– Regulate and Stabilize Conflicts – Establish mechanisms to mediate and manage conflicts, preventing them from destabilizing the project.

Regularly reviewing whether all end-user needs are met and aligning these mechanisms to address them is fundamental to a thriving, stable ecosystem. This proactive approach helps create a balanced and resilient system, where agents interact in a way that supports the project’s long-term goals.

Mechanism Design: Structuring Economic Dynamics

Once we define which behaviors we want to encourage or discourage in the system, it’s time to design the appropriate mechanisms. These mechanisms not only align with the system’s needs but also reinforce its resilience by mitigating the effects of external market pressure. They shape the project’s economic dynamics, influencing demand, supply, and user engagement. Most well-designed mechanisms manage demand and supply effectively, while motivating participants toward behaviors beneficial to the system. Some essential mechanisms to consider in your tokenomics design include:

Token Burning

This is a supply and demand control mechanism that manages inflation by reducing the circulating supply, maintaining scarcity through deflationary tactics. Token burning can also be used as a marketing event, where a portion of tokens is burned as the system or agents reach specific milestones. This way, it serves not only as an inflation control but also as an incentive for desirable behaviors.

Token Minting

This mechanism increases the token supply but should be carefully integrated and used judiciously. Minting may be necessary in cases where the project grows, such as in DePIN models or within internal game economies, where players mint tokens as part of rewards.

Staking

Staking stabilizes the system and reduces sell pressure. Token holders commit to locking up their tokens for a set period, earning rewards in return, similar to a savings deposit. This mechanism lowers sell pressure, especially during market downturns, as stakers would face losses by selling their staked tokens. Staking rewards incentivize token holders to contribute to network security and stability.

Airdrops

This mechanism distributes tokens to individuals who meet specific criteria, typically used pre-launch to counter the “cold start” problem, building community and creating marketing buzz. Airdrops can also reward dedicated users during the project’s lifecycle, recognizing specific groups that have fulfilled some tasks within the system. This type of reward helps improve user retention.

Vesting

Vesting gradually releases tokens to project contributors, such as team members or investors, instead of distributing them all at once. This prevents sudden token sell-offs and stabilizes the market. Proper timing of vesting periods within the project lifecycle is crucial, as sell pressure may increase once vesting ends. Dynamic vesting options, which allow for shortening the token release period to incentivize specific behaviors, are also valuable in tokenomics design and are carefully determined during the planning stage.

Mechanisms must align not only with the tokenomics structure but also with the project’s sector, the prevailing models within that space, and the project’s overarching goals. For example, a DeFi project may prioritize mechanisms for managing liquidity, balancing supply and demand, and ensuring stability during high volatility, as these elements are crucial for financial resilience and user confidence. In contrast, a GameFi project might concentrate on mechanisms that enhance user retention, such as in-game rewards, leveling systems, and token-based incentives to keep players engaged over time. Each sector has unique demands, and a successful set of mechanisms must fit both the market expectations and the project’s specific ambitions.

Securing Funding for Your Token Launch: Launchpads, Grants and Private Investors

Funding is a crucial component in any token launch, often determining the project’s reach, community trust, and market position. There are several key funding options to consider:

Launchpad Platforms

Launchpads are platforms specifically designed to facilitate the public sale and distribution of tokens for new blockchain projects. They serve as an accessible entry point for investors, allowing projects to raise initial capital while building a community of early supporters. By using a launchpad, projects gain visibility and credibility, leveraging the platform’s established user base and resources to jumpstart their journey.

Launchpad Selection

Selecting the right launchpad for your token issuance is crucial. Each launchpad has unique features, costs, and user demographics, so aligning with a platform that suits your project’s goals and target audience can enhance your launch’s effectiveness.

Cost Awareness

Be mindful of the fees associated with each launchpad, as these can vary significantly. Understanding these costs upfront ensures that your budget is prepared and helps you avoid unexpected expenses that could affect your launch.

Token Allocation and Scheduling

If using multiple launchpads, consider spacing out your launches over time to prevent market saturation. Additionally, some launchpads may have refund policies if token performance doesn’t meet investor expectations, so it’s important to be familiar with the terms and prepare accordingly.

Launchpad Size

It’s generally advisable to keep the launchpad size within a manageable range, such as $100k–$200k. This helps to maintain liquidity and demand without overwhelming the market, setting up a solid foundation for token stability and price growth.

Grant Opportunities

Grants are a popular funding mechanism in the Web3 space, providing essential resources to innovative projects and driving growth across ecosystems.

Case Study

Jak zdobyć Krypto Granty na swój projekt – Finansowanie w Web3

Researching Grants

Take the time to explore available grant programs, as many networks, including Ethereum, Solana, and NEAR, offer targeted funding aligned with different project types. For example, some ecosystems prioritize DeFi and DApps, while others focus on NFTs or infrastructure. Identifying grants that fit best with your project’s objectives can significantly improve your chances of securing valuable support.

Community and Ecosystem Support

Securing a grant from a reputable network not only provides direct funding but also enhances your project’s credibility and visibility. A grant acts as an endorsement, often attracting the attention of additional investors and partners, and connecting you with established community resources. This early validation can be critical for building hype and support in the Web3 ecosystem.

Alignment with Project Goals

Grants are designed to stimulate ecosystem growth by incentivizing projects that add value and address network-specific challenges. By focusing on grants that closely align with your project’s goals, you position yourself to secure funding from networks with a vested interest in your project’s success, creating mutual benefits for both your project and the network.

Selecting a Network with Grant Programs

When choosing the network on which to build, consider whether it offers grant support for new projects. Many networks actively fund early-stage projects as part of their growth strategy, providing both financial assistance and technical resources to support development. This network support can be instrumental in overcoming early challenges and establishing a solid foundation for your project.

To make your search easier, check out our curated list of 100 grant opportunities. It includes options that may suit your project’s needs and help you find resources to support its growth and goals.

Private Investors, VCs, and Angels

When attracting private investors, venture capitalists, or angel investors, every strategic decision—network selection, exchange type, and funding channels—plays a critical role. Investors want assurance that the team has thoroughly planned for the costs and support required, especially concerning network and exchange choices.

Investor Confidence

Each strategic decision builds credibility with investors. By clearly outlining network and exchange choices, anticipated costs, and expected network support, you show a deep commitment to project planning and financial stability, which helps reinforce investor confidence.

Transparency in Budgeting

Investors value transparency in fund allocation. Providing a clear breakdown of budget planning and responsible fund management strategies are critical for securing private capital. Clear communication of these aspects is essential, as investors need to trust that the project team has a complete understanding of budget implications and a solid plan for managing funds effectively.

Established Credibility

Demonstrating initial recognition or validation—whether through securing grants, forming a dedicated community, or generating early hype—helps attract private investors by showing that the project is already gaining traction. Community support and strong initial interest add to the project’s appeal by highlighting a committed user base.

Securing funding from diverse sources not only strengthens your project’s financial standing but also demonstrates to investors that their capital is well-managed and placed in capable hands.

Other Critical Aspects to Consider Before Your Token Launch

In addition to the essential considerations mentioned above, there are several other aspects that require careful attention to ensure a successful token launch:

Regulations

Navigating regulatory compliance is essential for any Web3 project. Start by ensuring that your project aligns with the legal jurisdictions in which it will operate. A fundamental step is to determine if your token classifies as a utility or a security, as this will affect its legal standing and compliance obligations. Obtaining a formal legal opinion is crucial to protect your project from unforeseen legal challenges and ensure alignment with current and emerging regulations.

Security

Project security is critical, especially regarding token liquidity and defense against potential attacks. Ensuring you have funds set aside for strategic buybacks can provide stability in fluctuating market conditions. Additionally, be aware that bot attacks, especially during high-traffic periods like token launches, can impact liquidity and token value. Investing in proactive security measures helps safeguard your project and reassures investors and users.

Community

A project’s community is its backbone. Establishing clear, accessible communication channels with your community builds trust and engagement. Beyond just building a following, consider whether there is excitement surrounding your project’s launch—buzz marketing and well-timed campaigns can significantly enhance visibility. Additionally, educational content and regular updates keep the community informed and engaged, helping them understand the project’s purpose and functionality. Incentive mechanisms, such as Airdrop rewards or staking benefits, further motivate community members and drive long-term loyalty.

Education

Effective communication is the cornerstone of a successful project launch. A clear, detailed document outlining system specifications allows both users and investors to grasp the project’s inner workings. Prepare educational materials, and ensure that information about token purchase processes is straightforward. Compatibility with widely-used wallets (e.g., MetaMask, Ledger, Trust Wallet) ensures that community members can easily store and manage tokens, improving accessibility and user experience.

Smart Contracts

The integrity of your project’s smart contracts is essential to its security and functionality. Conduct thorough security audits to identify and address potential vulnerabilities. Additionally, perform on-chain testing in test environments, such as testnets or on-chain validation systems, to simulate real-world scenarios and optimize performance. Testing thoroughly helps build a resilient, secure foundation for your project, reassuring investors and community members alike.

Ready to Launch? Let’s Ensure Your Token’s Success Together

Launching a token is more than just a technical endeavor—it’s a strategic journey that intertwines development, security, community engagement, and regulatory compliance. By following our Ultimate Token Launch Checklist, you can confidently navigate this complex landscape, mitigating risks and optimizing every aspect of your launch.

At Tokenomia.pro, we don’t just provide advice; we actively partner with you to fine-tune your tokenomics and simulate potential outcomes using advanced tools like CadCad. Our simulation-driven approach allows us to stress-test your tokenomics under various market conditions, identify vulnerabilities, and make data-driven adjustments to optimize for real-world scenarios. By crafting a tailored strategy that incorporates these insights, we help set you apart from the competition.

Remember, every successful token launch starts with a well-thought-out plan—and we’re here to make sure yours is a success. Take advantage of our free resources and expert insights, and let’s transform your vision into a thriving, impactful project.

Ready to get started?

Let’s talk about Checklist

The best first step is to talk to our consultant. During a free consultation, you can check the consultant’s competences and look for initial solutions to the challenge that is currently most important for your project.